Notably, over time with the advancements in the research, scientists have further improved the design and development process for these therapies. Owing to such improvements, the domain has recently seen the approval of four new ADCs, BLENREP® (2020), TRODELVYTM (2020), PadcevTM (2019) and POLIVY® (2019). Additionally, there are now close to 250 ADCs that are under development indicating the rising interest in this domain.

The manufacturing of Antibody Drug Conjugates (ADCs) is known to be complex, as it requires elaborate technical capabilities, along with manufacturing expertise related to both biologics and highly potent chemical substances. Moreover, it is estimated by several industry stakeholders that, 70-80% of ADC manufacturing operations are outsourced. They further believe that this likely to persist in the coming years, as well. This is driven by the fact that majority of the small and mid-sized companies are anticipated to continue outsourcing their ADC manufacturing operations. Hence, given the anticipated growth in demand for ADCs, the contract manufacturing market in this domain is also anticipated to witness substantial growth in the coming years.

Companies Offering Contract Manufacturing Services for the Production of ADCs

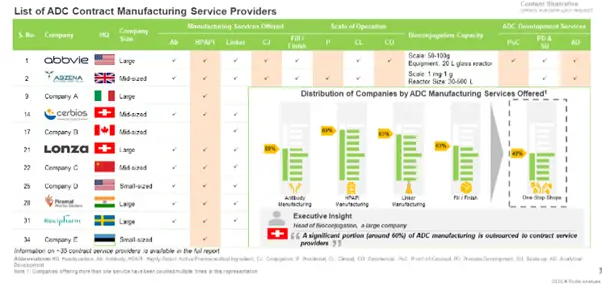

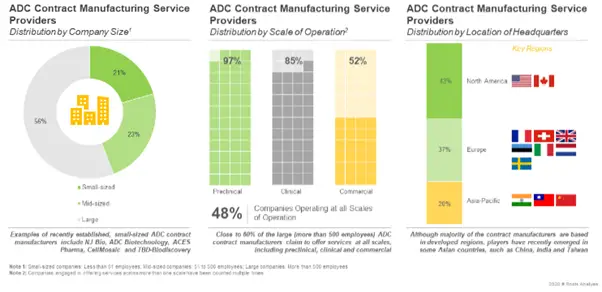

Presently, around 35 players, across the globe, claim to have the required capabilities to offer contract manufacturing / conjugation services for Antibody Drug Conjugates (ADCs); of these, over 15 players are one-stop-shops.

To know more about the stakeholders and the respective services offered by them, check out our report at.

Further, the current market landscape features the presence of both well-established and new entrants. Around 50% of these service providers claim to operate at all scales of operation.

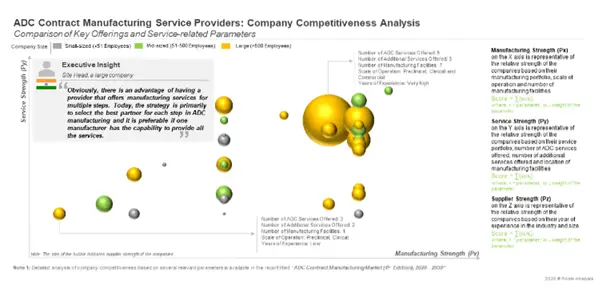

Who are the leading ADC contract manufacturers, across the world?

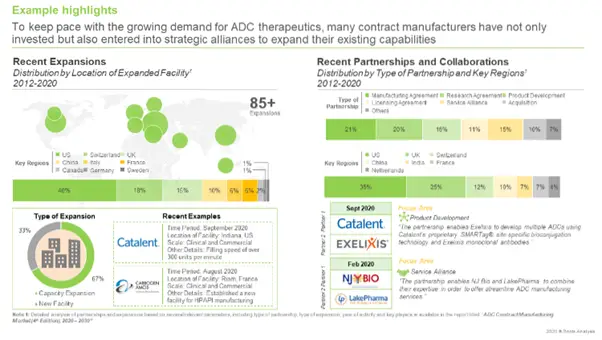

In order to develop a competitive edge, companies are putting in significant efforts and capital investments towards expanding their capabilities and, thereby enhancing their respective service portfolios.

Recent Developments that have taken Place in the ADC Contract Manufacturing Domain

Several contract manufacturers have made significant investments for the expansion of their respective capabilities and working capacities. Some companies have also established new facilities dedicated to bioconjugation and / or manufacturing of highly potent / cytotoxic compounds. During our research, we identified around 85 such developments which were reported during the period 2012 – H1 2020; of these, 67% were instances of facility expansions.

The field has also witnessed the establishment of several partnerships between drug developers and ADC manufacturers or contract service providers. We were able to identify around 60 collaboration agreements, which were inked during the period 2012 – H1 2020.

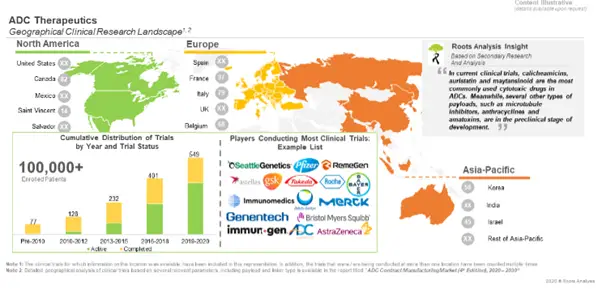

Several Clinical Trials Focused on the Evaluation of ADCs have been Registered Over the Past Few Years

During our research, we came across ~550 registered clinical trials focused on ADCs (both marketed and clinical stage therapeutics), during the period between 1997–2020 (till August). Most of the trials were registered in North America (47%), followed by Europe (32%). The abovementioned studies were conducted on more than 100,000 patients who were recruited across different geographies.

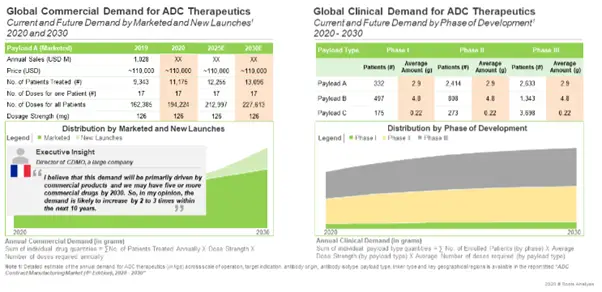

The Demand for Contract Manufacturing of ADCs is Anticipated to Increase Rapidly in the Coming Years

The demand for such products is projected to grow at an annualized rate of over 17%. Currently, around 80% of the total demand is driven by commercially available products. As more late stage product candidates are approved, the share of commercial scale demand is expected to increase to 94% by 2030.

To know further about the insights of this analysis, check out the report here.

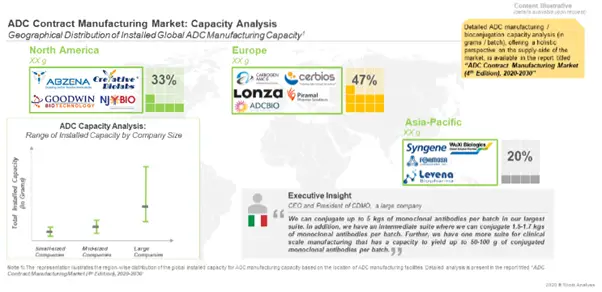

The Global Capacity for ADC Contract Manufacturing is Driven by Mid to Large-sized CMOs

A major share (over 60%) of the global capacity is installed in facilities of mid to large sized CMOs. Around 50% of the total capacity is installed in facilities based in Europe, which also has the largest number of bioconjugation facilities in the world.

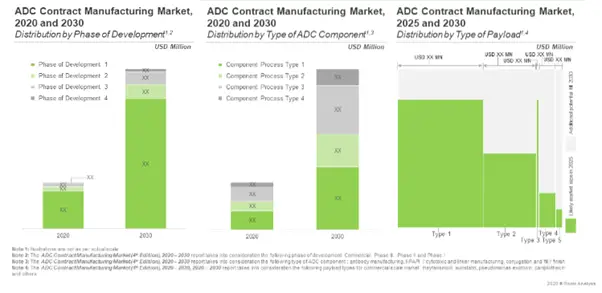

Likely Growth of ADC Contract Manufacturing Services Market

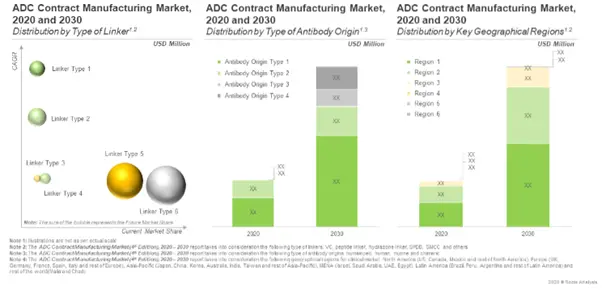

With over 70% of the ADC manufacturing operations currently, being outsourced, we expect the market to grow at an annualized rate of over 12% during the next decade

Further, the anticipated opportunity is expected to be segregated across a variety of linkers and antibodies; it is also likely to be well-distributed across key geographical regions

Check out our new Reports Here-

ADC Contract Manufacturing Market (4th Edition)

You may also be interested in the following titles:

- Cold Chain Logistics Market for Vaccines (including Coronavirus (COVID-19 Vaccine))

- Digital Solutions for Biomarkers Market by Content

- Antisense Oligonucleotide Therapeutics Market by Target Indication

The post Antibody Drug Conjugates (ADCs): A Deeper Look into Contract Manufacturing Landscape appeared first on Blog.