What You Should Know:

– New CHIME-KLAS interoperability report reveals steady

progress in some areas related to interoperability and leaps forward in others.

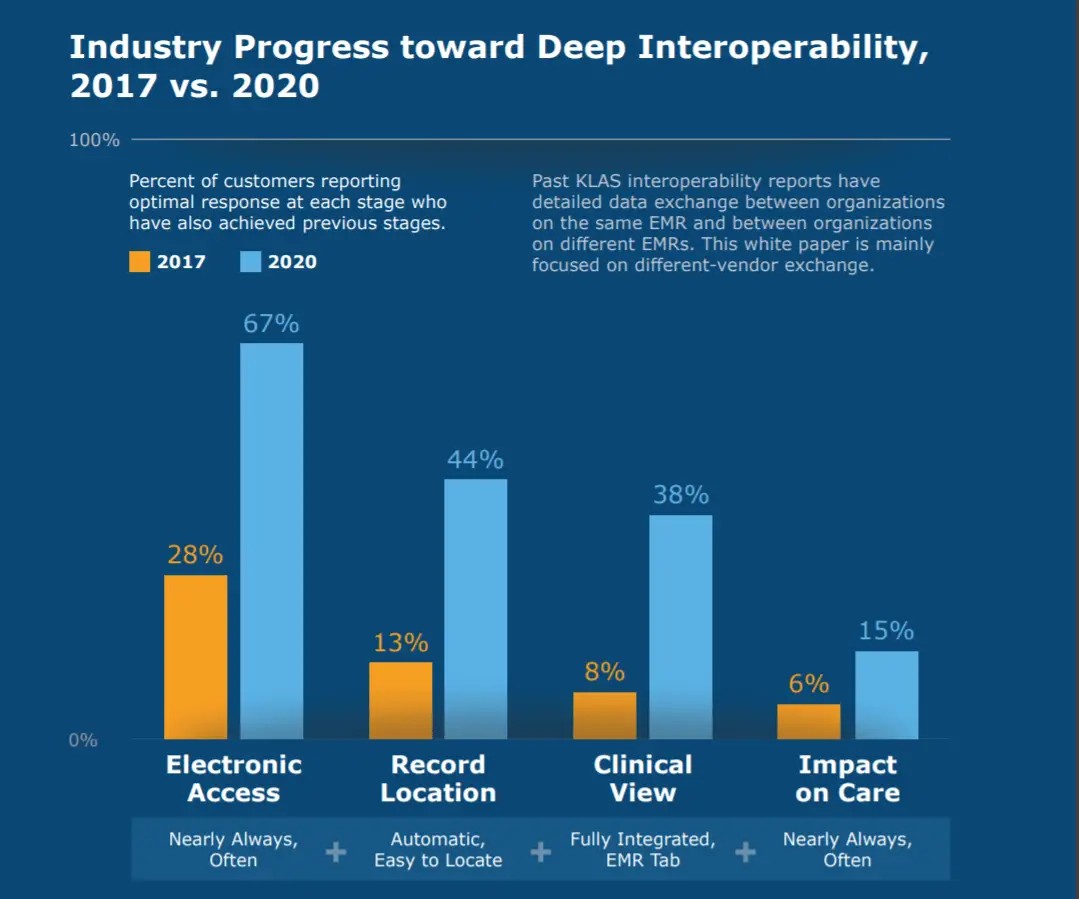

– A total of 67% of provider organizations reported they

often or nearly always had access to needed records in 2020, up from 28% in

2017. Providers noted improvements in functionality and usability for tasks

like locating and viewing records.

Both providers and the companies that produce the hardware and software needed to exchange and use electronic health information continue to make progress in their efforts to advance healthcare IT interoperability, according to a white paper released today by the College of Healthcare Information Management Executives (CHIME) and KLAS Research.

Providers Cite Steady Progress in

Interoperability

The report reveals providers cited steady

progress in some areas related to interoperability and leaps forward in others.

CHIME-KLAS cites a total of 67% of provider organizations reported they often

or nearly always had access to needed records in 2020, up from 28% in 2017. Providers

noted improvements in functionality and usability for tasks like locating and

viewing records. Vendor support of data sharing improved between 2016 and 2020,

with the biggest gains between partnering organizations using different EMRs.

Overall, providers were increasingly optimistic that these changes will allow

record exchange to have a greater impact on patient care in the future.

“For digital health to reach its full

potential, we need to be able to safely and securely exchange information

across the healthcare ecosystem,” said CHIME President and CEO Russell P. Branzell.

“Interoperability is the linchpin. With the Cures Act and other federal

initiatives promoting data sharing, we should see even more gains that

ultimately will improve patient care. As is evident in the survey results,

great strides have been made resulting in remarkable improvements. This

required hard work for all parties involved and they should be congratulated on

their collective efforts.”

10 Key Trends in EMR Interoperability

The report highlights the following 10 EMR

interoperability trends in the industry based on data from a 2020

interoperability survey, with comparisons to results from past surveys.

1. Deep Interoperability Is Progressing, with Many

Organizations Poised for Significant Progress in Coming Years.

The rate of provider organizations achieving deep

interoperability has doubled since 2017. The overall rate leaves much to be

desired, but signs of progress are visible.

2. Almost All EMR Vendors Have Improved Connections to

Outside EMR Solutions

The biggest gains have come because of vendor proactivity;

vendors who take an active role in helping push provider organizations to

success have seen the most progress.

3. Ambulatory Clinics and Smaller Hospitals Are

Connecting More Than Ever Before

KLAS market share data has shown a steady trend of EMR

vendor consolidation over the past several years. Interestingly, this

consolidation has resulted in more needed connections with critical exchange

partners, not fewer.

4. High Costs and Lack of EMR Vendor Technical Readiness

Make Interoperability Harder for Half of Surveyed Providers

The most mentioned barrier to success was cost. Buying the

latest features and functionality, paying for new interfaces and connections,

and the cost to keep up system customization are frequent complaints.

5. National Networks Have Reached a Tipping Point

Today, perceived value and adoption are higher than ever

before, and organizations leveraging these networks are significantly more

likely to report achieving deep interoperability.

6. App Use Still in Early Stages; Patient-Facing App Use

Growing

Patient-facing apps are some of the most commonly used

across the healthcare app landscape. Some provider organizations are leveraging

apps from their vendor. Apple is the most common third party being leveraged

for this use case.

7. FHIR Adoption Begins to Take Hold in Large Health

Systems

The bulk of FHIR adoption comes from customers of large EMR

vendors, and these organizations are are primarily leveraging FHIR APIs for

patient-record exchange, clinician-enabling tools, and patient-facing tools.

8. Intended ROI of FHIR Unclear for Many

Organizations question the value of FHIR because of three

primary concerns: (1) lack of patient adoption of apps, (2) an unclear

connection between use-case adoption and the intended outcomes, and (3)

difficulty quantifying the potential outcomes they have identified.

9. Proprietary API Adoption Is Proving Valuable

Patient-facing tools, clinician-enabling tools, and

patient-record exchange are the primary use cases for proprietary APIs—just

like with FHIR.

10. Robust Record Exchange and Population Health Are Top

Needs Going Forward

When asked what interoperability use cases their vendor

should focus on in the next two to three years, provider organizations

primarily spoke about enhancements to patient-record exchange.