Launching omnichannel? Think about your HCP segmentation model… twice

If you wake up an omnichannel expert in the middle of the night with the question, “what does omnichannel strategy implementation start with?”, you will likely hear “segmentation” among the other mumbled words. In fact, any decent omnichannel strategy requires proper target audience segmentation to run, and pharma marketing is no exception. The issue here is pharma marketing has its own traditions and is unlike anything else – so you cannot simply copy paste best practices from other industries and hope they will work out. In this article, we will look at what segmentation really is for omnichannel strategists, and how to reconcile the innovative takes with what life sciences are doing now.

Slicing the Database Pie: What target audience segmentation really is (and is not)

In general, segmentation refers to any practice of dividing your target audience (be it existing accounts in the CRM, prospective accounts or entries in a database or even population groups you target) into segments according to a set of relevant principles. On an instinctive level, all of us in marketing have that notion: you have a target audience that is a mixed crowd, but you want to be relevant to as many of them as you can. Instead of offering every person at a party a glass of wine and a steak, you want to cater to those who won’t go for that first option. In terms of an HCP audience, physicians are different, too, and no one can reasonably expect that an eDetailing slide or other content focusing strictly on patient challenges or costs will compel everyone to consider prescribing.

On the other hand, you will not create new content for everyone, so you will want to at least approximate their actual interests with maximum precision, while maintaining the entire effort at feasible cost-efficiency level. Segmentation is a little bit like a digital audio file: technically, the sound wave is sliced into segments for more convenient file weight, but the outcome (for most) is a normal listening experience.

If we take that analogy further, it may seem that the more segments there are, the better: after all, we are approximating the ideal ultra-personal engagement. In reality, though, it is not the case. First of all, there is content – if you have too many segments (carefully sliced up by your analysts based on a 12-dimensional matrix) each containing a handful of HCPs, there will be more of these categories than agencies available to craft all that content. Secondly, humans are highly complex, and the account in one segment today may be found in a different one tomorrow.

Omnichannel, when done correctly, is a powerful tool that can furnish monstrous amounts of customer data. Thus it is important to remember what omnichannel audience segmentation is – and is not:

- It is NOT segmenting based on anything you can think of, down to loads of tiny segments just because you can

- It IS segmenting carefully based on the criteria that are relevant to your business, brand, and situation

Why bother? On the importance of segmentation

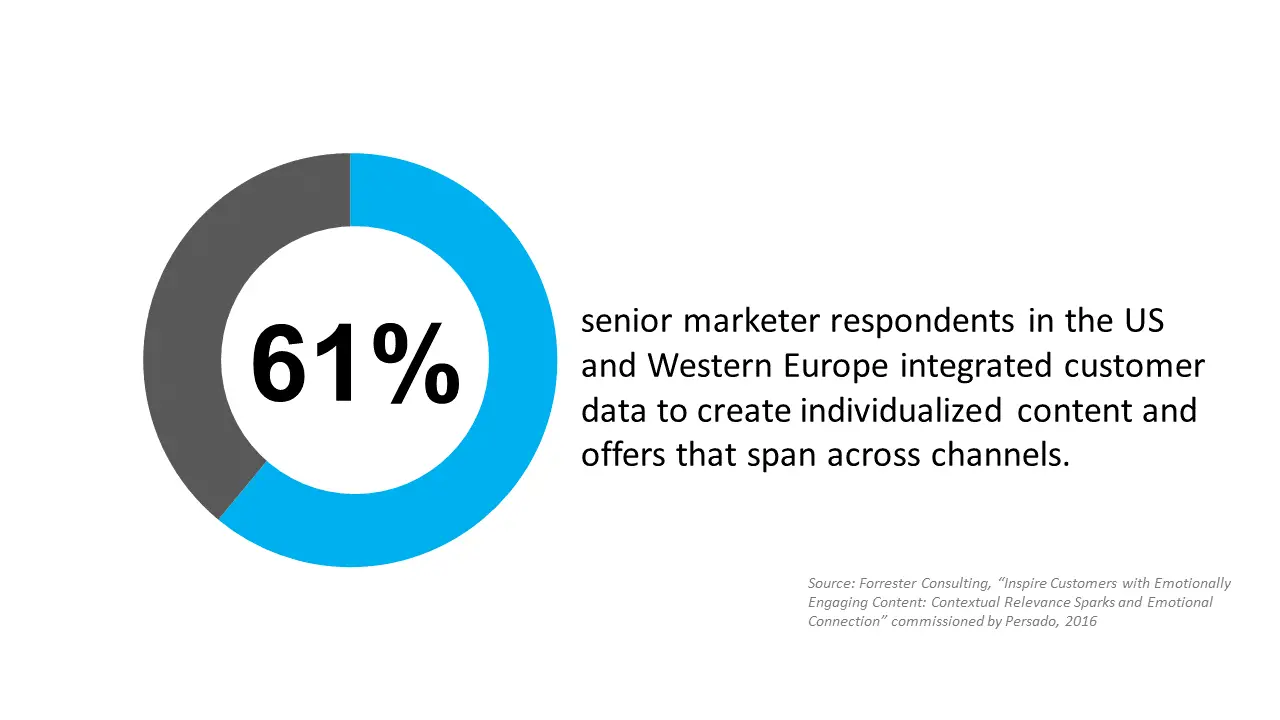

The benefits of properly segmented campaigns are immense. This is especially obvious in channels that are easy to measure in terms of metrics, like email. For example, research on email campaigning found that segmentation provided for 51.9% higher click through rates, and over 110% higher open rates. This is just one example, though. On a more systematic level, the advantages are:

- Your tactics are stronger and yield better results. With proper segmentation, you can identify more precise engagement moves that are likely to get HCPs involved – since they are focused on their actual needs. This impacts conversion: even in a non-personal promotion channel like online ads, conversion rate for targeted ads rises from 2.8% to 6.8% – more than twofold.

- The affinity between brand and customer increases – impacting loyalty. It is essentially a principle very similar to provide beyond-the-pill value in pharmaceutical promotion – if an HCP feels there is so much more to their interaction with the brand than just listening to standard key messages, they are more likely to perceive this value favorably and become loyal brand advocates.

- Quality leads. One of the best things about doing segmentation right is that once you have identified a segment properly, the audience within that segment that was under your radar suddenly becomes more accessible – and you already have the content and methods to provide then the value they seek.

- Brand image and perception in the community. Customers form communities, and the power of reviews has been demonstrated. This is also true of the medical community, with key opinion leaders of different caliber swaying the fates of pharmaceutical products in entire regions. Segmenting your omnichannel campaigns will provide the HCPs with targeted messaging and the reasons they personally need to refer to your brand as a trusted and valued one.

The most common segmentation model components (as used in web campaigns)

A segmentation model is essentially the set of criteria that you choose to segment based on. To provide an example with HCP audience, in some cases, it may be location + specialty + patients count, in other cases, the psychological type (see below) + specialty + preferred channel, and so on. Of course, these examples are somewhat too abstract, as a larger, more realistic combination is always based on the brand and campaign (as well as other factors).

For an overview of the most common criteria for segmentation, it is useful to look at what web campaigns have to offer:

- Demographic data

- Age and gender

- Location

- For B2C:

- Income

- Ethnicity

- Family status

- For B2B:

- Industry

- Company size

- position

Translating this into the pharma-HCP world, we get:

- Age and gender

- Location

- Family status

- Specialty

- Employment at HCO

- Amount of patients

- Position in the community

- Behavioral data

- Purchasing habits

- Preferred channel of interaction

- History of interactions with brand (frequency, proactivity, etc.)

In HCP segmentation:

- Prescribing habits (open to innovation/experiment, traditionalist, etc.)

- Preferred channel of interaction (rep calls, email, messengers, EHR)

- History of previous interactions (email open rate, etc.)

- Psychological data

- Personality (introvert/extravert, etc.)

- Values and priorities

- Interests

For HCPs, a similar list would apply, as well.

- Geographical data

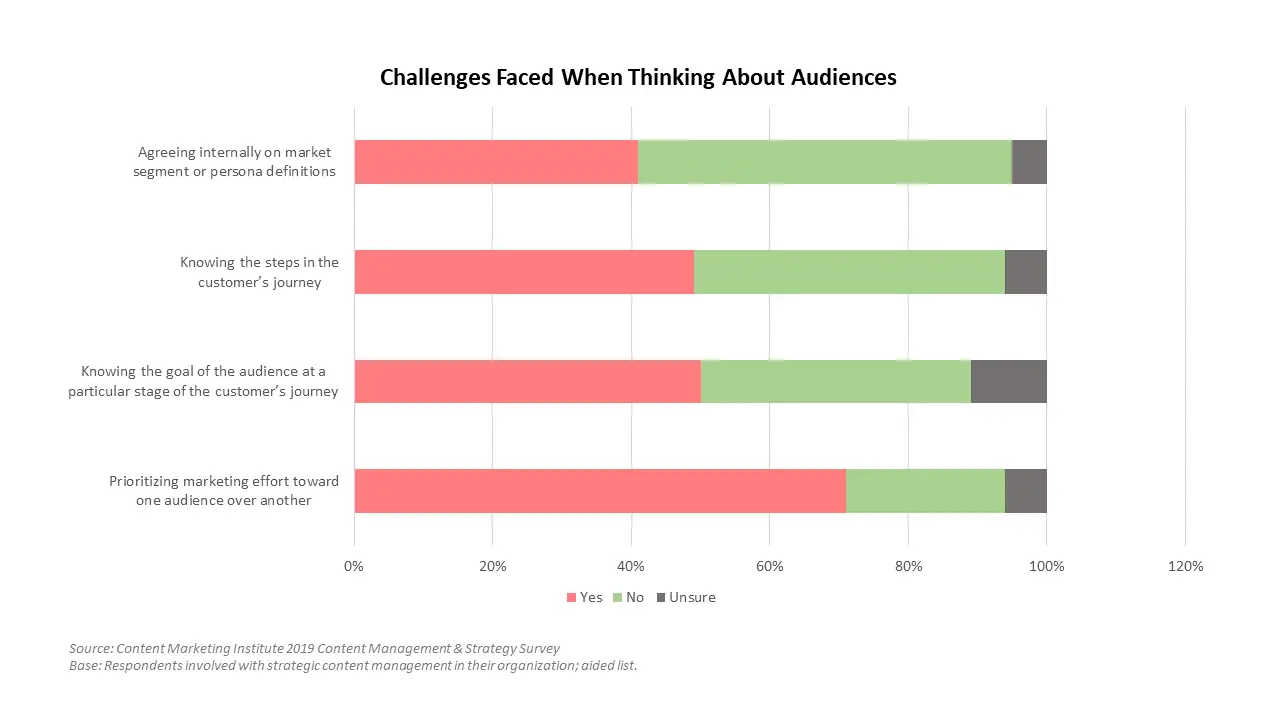

What is pharma up to?

For the most part, the segmentation model components above have been developed in online campaigns, where the marketer is distant from the customer. But pharma lives in a different, much more personal reality already, with CRM and rep calls serving as a good launchpad. The question is, once you adopt more channels, each with their own metrics, and then start building a complete picture, how do you combine the two parts? This is where it pays off to look closely at what pharma already has.

Existing pharma segmentation practices and why they are not enough

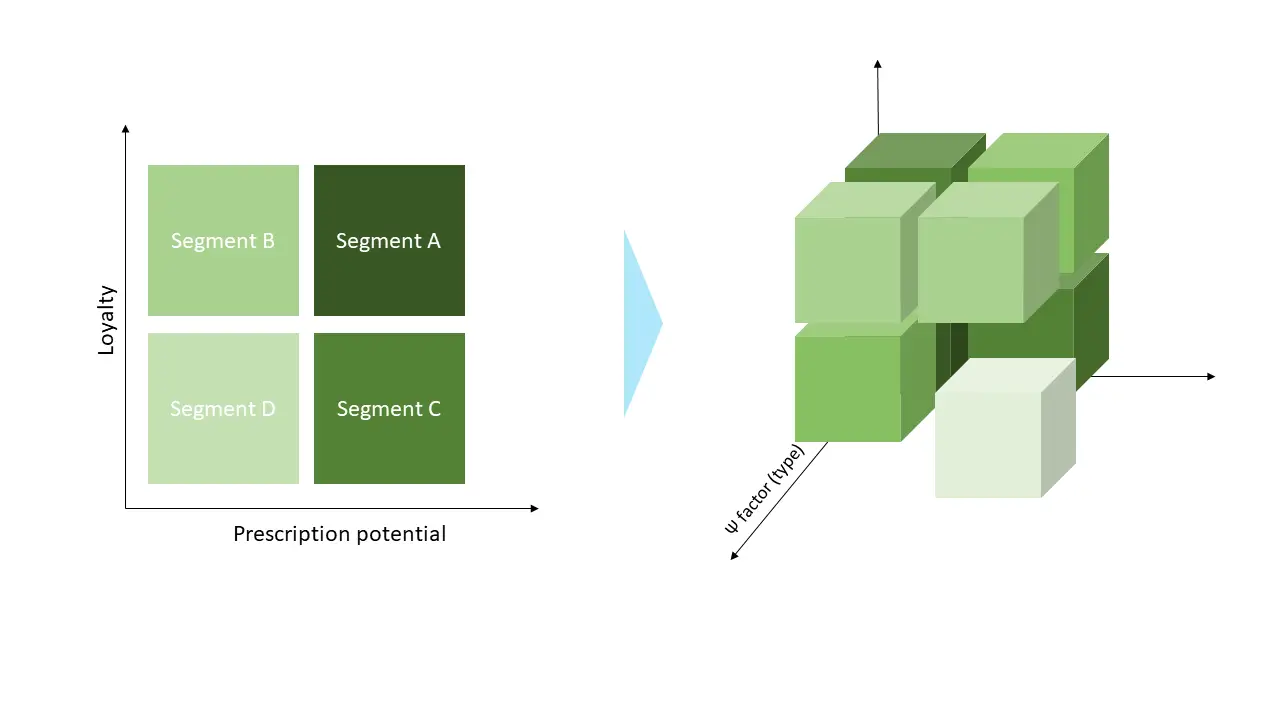

It could seem that with the insight-collecting possibilities provided by CRM/CLM and the reps going from doctor to doctor, the segmentation would be more sophisticated for the F2F channel. In reality, though, most organizations stick with simplified segmentation models based around their own immediate goals. While reps may be instructed (ultimately by global office) to collect data in the CRM, the actual decision making for the cycle still often relies on two criteria:

- Loyalty

- Prescription potential

The problem is that this is a brand-centric, not a customer-centric model. Everything revolves around the question, “what can this account contribute to brand promotion and is it worth it to sway their opinion?”. Of course, no marketer can escape these two factors, but this segmentation only tells how hard to try to engage – not how to engage. In this situation, it is the representatives who possess the insights on each HCP, their preferences and psychological traits – but representatives do not decide what content to make, at least directly.

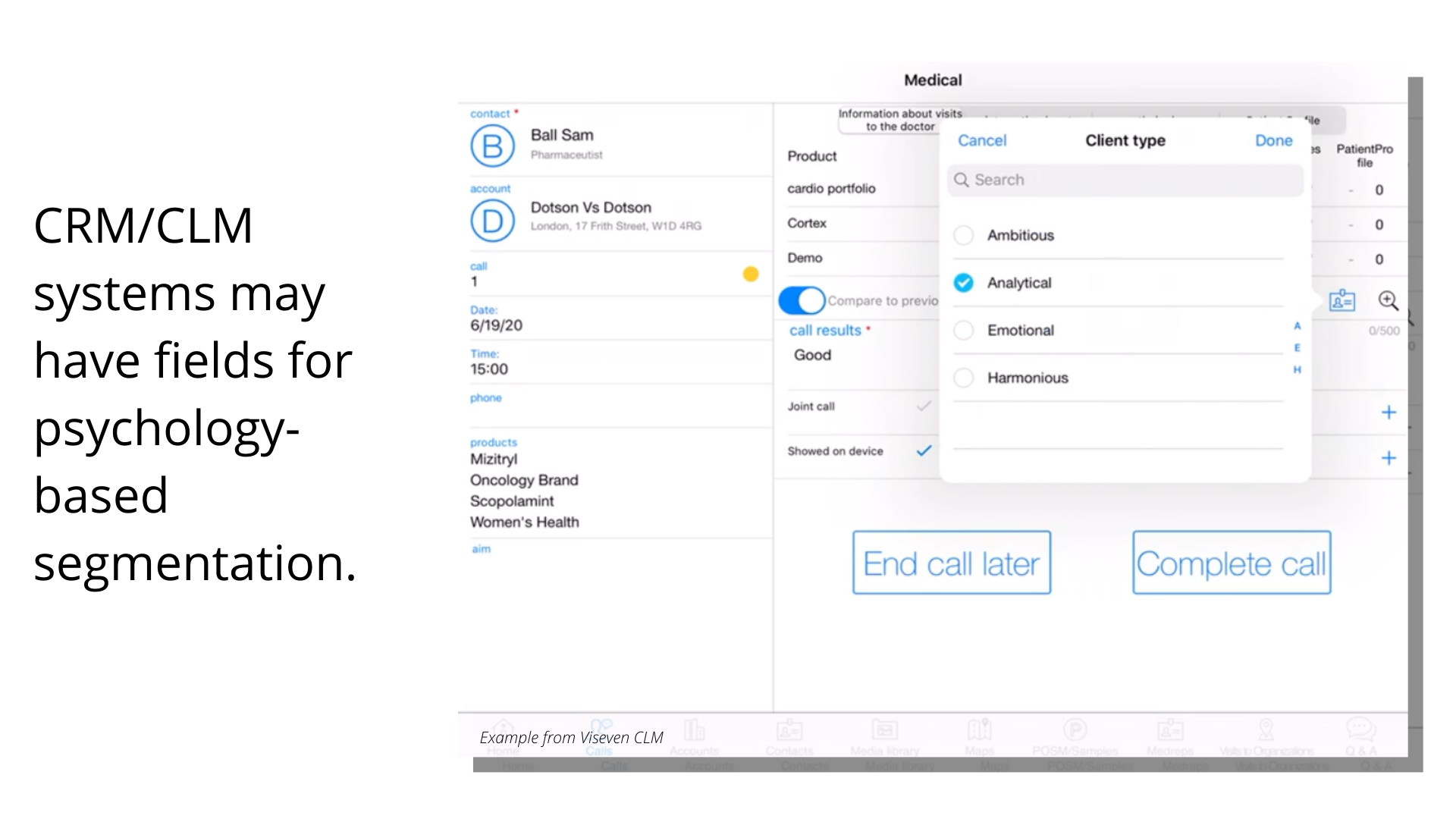

And, of course, this is not too helpful with other channels than rep calls. Most organizations are, by now, using entire sets of different channels, with email segmentation often existing in a different universe. Meanwhile, a smarter take on rep-collected metrics involves psychology.

Psychographic segmentation (the Ψ-factor)

Nothing can be more beneficial in crafting high-ROI targeted campaigns than knowledge of the target audience’s psychology. Now, in B2C, and especially FMCG industries (where omnichannel practices first emerged) the situation is admittedly simpler than in pharma marketing, since the consumer choice is not overshadowed by regulations and a hefty dose of scientific evidence required in making prescriptions. However, as noted above, experienced and high-performing reps do use psychology during their calls a lot – if only to establish that famed personal connection with the HCP.

When you want to expand to multichannel, and then omnichannel, the last thing you want to lose is that connection. Besides, being aware of what really moves this or that segment of physicians to favor the product over others helps create content that actually performs. This is why companies are starting to include psychological data into their segmentation models, providing a further dimension:

A number of CRM systems have fields configured for this data – currently, not many marketers use them in commercial operations planning, though.

The trick here is to define what psychological traits will be helpful outside of the CRM – and in the wider world of omnichannel engagement. That which lies on the surface – introversion/extraversion, Myers-Briggs types, empathy scales – is not very helpful per se. That is, until you find combinations that serve to determine common psychological types. You may notice, for example, that the more pragmatic, cost-aware physicians are also patient centric in their values and generally more open to communication with pharma regardless of their introversion/extraversion score. In another article in this blog, we described cases when such psychological typing helped develop fragments for rep-triggered email campaigns that reps could then combine before sending to HCPs.

The same logic can be extended to other channels, influencing their choice (and the choice of key messages) when building omnichannel customer journeys.

Emerging data layers… and discrepancies

As life sciences are embracing ever more channels, management boards come across segmentation principles and models that are traditional to those channels. Take email (mass mailing, not the rep-triggered email) – this channel comes with its own segmentation models that include browser/device use, and even habits as to when the customers open the emails (impacting sending time). Web, too, has its own segmentation practices, involving geolocation and other things tracked with click maps and SEO-related research.

Do these models have a life in pharma? No doubt. Do they have value outside the channels they were developed for? Sometimes. What is the issue to solve? Few people take time to put these different models together and filter out what criteria are relevant everywhere, regardless of the channel. Instead of a brand-centric segmentation model we covered earlier, multichannel brings about a channel-centric one.

This needs to be broken, and this break is part of transition to omnichannel. Integrating data from different channel-specific platforms is the tech side of the question – and is already being implemented at many organizations. The next stage is a shift towards a truly customer-centric mindset.

New segmentation practices for omnichannel pharma communication

What is the future of segmentation and targeting in pharmaceutical marketing? What practices are sustainable in an omnichannel model? Various organizations are working on their own models, but here are some common findings that our own expertise at Viseven confirms.

How to implement

Thankfully, there is no need to start from scratch – a good practice is to build upon what your organization has aggregated throughout the years: the HCP base, CRM data, insights identified by reps, email metrics and questionnaires. As you add more channels, think about whether the segmentation that seems obvious within those channels contributes to the overall ROI of the omnichannel campaign – not its channel-bound part.

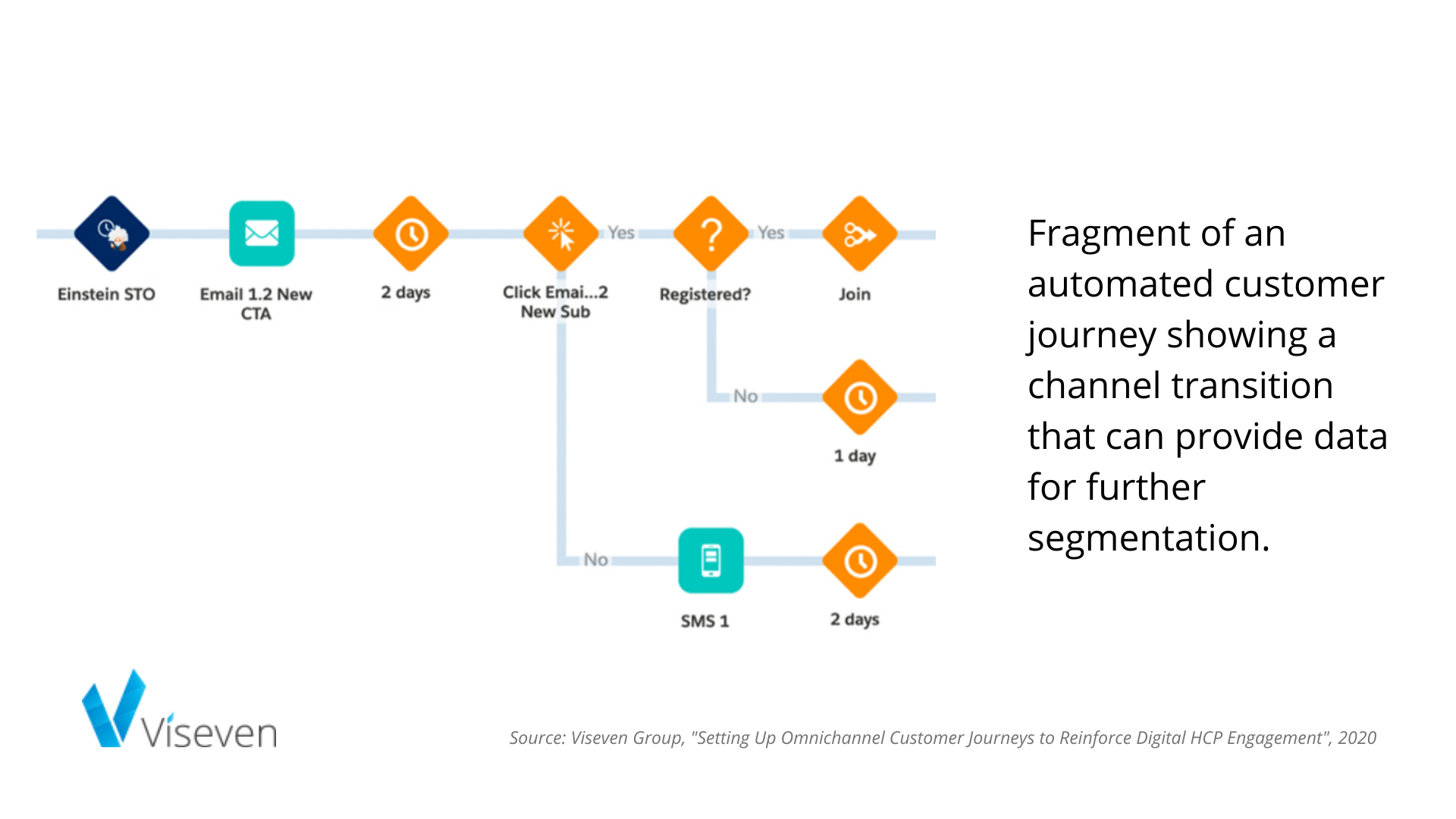

Another important thing to consider is that segmentation is an ongoing process, rather than a once-and-for-all initial step. Omnichannel starts with segmentation, but not chronologically so – just logically. Additional data is harvested in the course of an omnichannel campaign. In a recent case study, we described a case when the HCPs’ reaction to an automated email resulted in them either moving to the next step, or the management changing the key message, or changing the channel to a messenger. It is only natural to use the data on message or channel preferences obtained in this way to segment the audience further along the way, refining the approach.

A common mistake

We have briefly alluded to it, in fact, when talking about the approximation analogy. It is crucial not to make segmentation a goal in itself – refining here is not about creating an array of categories that multiply to produce a host of extra small segments. It is the message that matters, and one should really start with thinking about the message (or messages) they want to convey. It is in connection with the messages you want to get through that you can define what insights are relevant for segmentation.

Integrate at every step

Finally, the most important point – there should be one governing segmentation model that is above any channel – even above the CRM. This is what makes omnichannel different from an extended multichannel model – it is the HCP with their needs and the value your brand brings that is central, not the possibilities of a single channel, however efficient.

This requires a common data pool across channels – and integration of the corresponding platforms that underlies it. With a robust, integrated omnichannel architecture, you can not only put together the data from, say, CRM, email and web or social, but make decisions based on the extended picture of the customer you have.

For more practical and actionable information, professional advice and technical expertise to build a segmentable and segmented omnichannel strategy, contact our experts. With experience setting up omnichannel architectures and campaigns based on the customer’s existing infrastructure, our experts know how to make your current technical and data capacities work to their maximum in a new omnichannel mindset – which you can then extend and scale.

The post Launching omnichannel? Think about your HCP segmentation model… twice appeared first on Viseven.