What You Should Know:

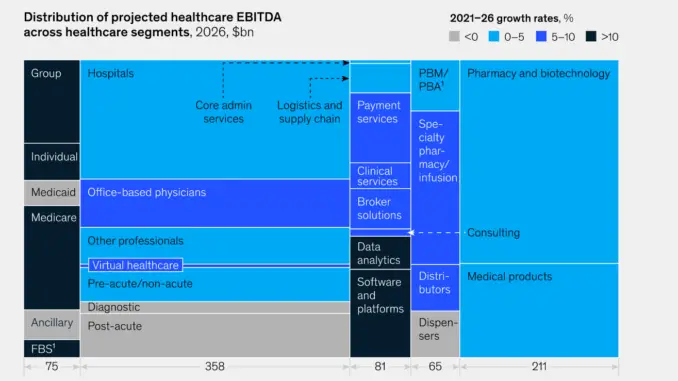

– Healthcare profit pools are expected to grow 4 percent annually resulting from $654 billion in 2021 to $790 billion in 2026, according to a new McKinsey report.

– The report reveals inflation is not transitory and the economic outlook has meaningfully darkened due to a healthcare worker shortage and endemic COVID-19.

What to expect in US healthcare in 2023 and beyond

The US healthcare industry faces demanding conditions in 2023, including recessionary pressure, continuing high inflation rates, labor shortages, and endemic COVID-19. But players are not standing still.

Key findings from the report are as follows:

1. Healthcare services and technology is expected to be the fastest growing sector in healthcare at 10 percent annual growth between 2021-2026 (potentially landing at $81 billion by 2026). On the other hand, the outlook for some segments has worsened compared with previous analysis, including general acute care and post-acute care within providers and Medicaid within payers.

2. The Government segment’s profit pools are projected to land nearly 50 percent greater than the Commercial group segment by 2026 ($33 billion compared with $21 billion). In July 2022, it was estimated that 2021 payer profit pools to be $40 billion, however, actual 2021 profit pools were $5 billion higher Higher Medicaid EBITDA margins due to the extended public health emergency accounted for the majority of the increase, although it was partially offset by lower-than-expected commercial margins with the return of deferred care.

3. Increased labor costs and administrative expenses are expected to contribute to reduced earnings before interest, taxes, depreciation, and amortization by about 60 basis points in 2022 and 2023 combined. Previously, in July 2022, it was estimated that provider profit pools would grow at a 7 percent CAGR from 2021 to 2025. The current forecast is that of a 3 percent CAGR from 2021 to 2026 in updated and expanded estimates, with the decline primarily due to increased costs owing to high inflation and labor shortages.

4. Payer profit pools are expected to grow at 11 percent annually reaching $75 billion in 2026. Growth in 2021 resulted from making up for care deferred from the first year of the COVID-19 pandemic as well as additional healthcare demand attributable to COVID-19. Provider profit pools faced substantial pressure in 2022 and are likely to continue to do so in 2023 as a result of inflation and increased labor costs.

5. Payer profit pools are likely to see slower than normal growth between 2022-23 due to inflationary pressure and provider reimbursement rate increases.

6. Provider profit pools are also expected to see slower growth annually than previously predicted (3 percent growth annually from 2021-26, compared to the 7 percent figure previously predicted). Three factors account for the anticipated faster growth in HST. First, analysts expect higher demand from payers and providers to improve efficiency and address labor challenges. Second, payers and providers are likely to be willing to absorb vendor price increases where there is clear value. Third, experts expect HST companies to make operational changes that will improve efficiency, including through the use of technology and automation across services.

7. Increased labor costs and administrative expenses are expected to contribute to reduced earnings before interest, taxes, depreciation, and amortization by about 60 basis points in 2022 and 2023 combined.