With its share price falling from more than $66 to less than $24, September was a tumultuous month for Nanox.

On August 25th, the medical imaging start-up closed its initial public offering, having raised $190m from the sale of 10,555,556 ordinary shares at a price of $18 each. Money poured in as investors were sold on Nanox’s cold cathode x-ray source and the subsequent reduction in costs that it would enable, as well as the vendor’s pay-per-scan pricing model that would let the company access new, untapped markets.

A week later the shares were being traded for almost double their opening amount, and by the 11th of September, they had reached a peak of $66.67. This meteoric rise soon came to an end though, as activist short-seller Andrew Left of Citron Research published a report comparing the Israeli start-up to disgraced medical testing firm Theranos and asserted that the company’s shares were worthless.

Other commentators added to Left’s criticism, causing investors to abandon the stock. Class action lawsuits followed, with legal firms hoping to defend shareholders against the imaging company’s alleged fabrication of commercial agreements and of misleading investors.

Nanox defended itself against the Citron attack, insisting that the allegations in the report are ‘completely without merit’, but the extra scrutiny and threat of legal repercussions have left the share price continuing to plummet, falling to $23.52 at month’s end.

Vendor Impact

– New business and payment models could capture demand from new customers in untapped and emerging markets

– Vendors should be reactive. A successful launch of Nanox’s X-ray system could channel more focus and resources on the portfolio of low-end X-ray systems

– Once established, recurring services are hard to displace

– However, brand loyalty and hard-earned reputations aren’t easily forgotten

Market Impact

– Potential for disruptive technology to expand access to medical imaging and provide affordable X-ray digital solutions, delivering a significant and rapid overall market expansion

– New customer bases could have less expertise and a lack of trained professionals – ease of use becomes a critical feature

– Where X-ray system price is a battleground, and a fundamental factor driving purchasing decisions, Nanox’s proposed ecosystem offers revenue-generating opportunities

The Signify View

Assessing the viability and long-term potential of any business is a dangerous game, doubly so if it depends on a closely guarded game-changing technological innovation as is the case with Nanox. Fortunes are won and lost on a daily basis by investors, speculators, and gamblers trying to get in on the ground floor of the next ground-breaking company after being convinced by slick presentations and thorough prospectuses.

There is likely merit in some of the arguments being put forward by those on either side of the Nanox debate. For example, the lack of peer-reviewed journal articles about new technology is questionable. But, the skepticism around the feasibility of Nanox’s technology seems to ignore that research into cold-cathode x-ray generation, the cornerstone of Nanox’s offering has been ongoing for numerous years, and isn’t as out of the blue as the naysayers may suggest.

Regardless of these and other specifics in the ongoing fracas between short-sellers, Nanox, investors, and lawyers, all of whom have their own agendas, the voracity with which the stocks were initially purchased shows the keen appetite investors have for a company that would bring disruption to the X-ray systems market.

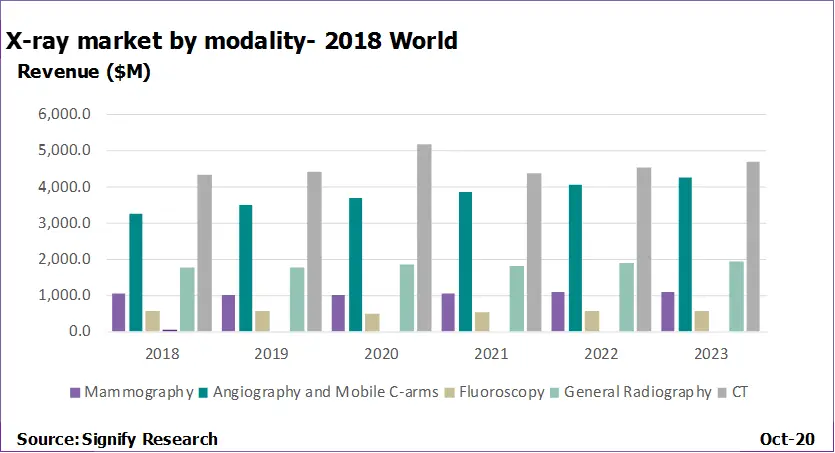

When delving into Signify Research’s data on this market, it is easy to see why. Across many developed and mature regions, the market has become relatively stable. It is one of replacement and renewal rather than selling to new customers and increasing the accessibility of X-ray imaging. Developed markets do continue to drive growth for X-ray manufacturers to some extent, particularly as a result of digitalization and favored reimbursement for digital X-ray imaging. However, by and large, the market remains broadly flat, with a CAGR of just 2.7% forecast for the period 2018-2023.

Figure 1: While there are some growth areas, the X-ray market as a whole is very stable

New business

Nanox has strong ambitions to outperform this underwhelming outlook by utilizing its unique and more affordable technology to offer a relatively feature-rich system, dubbed the Arc, at a far lower price than existing digital X-ray systems. Competing on price is only one part of the equation, however.

After all, there are countries where, despite their economies of scale, the multi-national market leaders in medical imaging are unable to compete with domestic manufacturers, which are able to produce X-ray systems locally, with lower overheads, and no importation costs. Globally, there are also a large number of smaller imaging vendors, which have limited, yet low-cost offerings at the value end of the market, with this increased competition driving down average selling prices.

To differentiate itself further, Nanox also plans to launch with a completely new business model. Instead of traditional transactional sales, which see providers simply purchase and pay the full cost of the imaging system in one installment, use the system for the entire shelf life of the product and then replace with an equivalent model, Nanox plans to retain ownership of its machines, but charge providers to use them on a pay-per-scan basis.

There are some regions and some situations where legislation and other factors make this model unfeasible, so Nanox will also make its products available to purchase outright, as well as licensing its technology to other firms. However, the start-up’s focus is on offering medical imaging as a service.

The company says that this shift from a CapEx to a managed service approach means that instead of competing with established vendors over market share, it will be able to expand the total market, enabling access to imaging systems in settings where they have been hitherto absent, with urgent care units, outpatient clinics, and nursing homes being suggested as targets.

According to the Nanox investor’s prospectus, current contracts already secured (although the legitimacy of these deals is one of the issues raised by the short-sellers) feature a $40 per scan cost, of which Nanox receives $14 – although the exact figure varies depending on regional economics. The contracts feature a minimum service fee equivalent to seven scans a day, although the target is somewhat higher, with each machine expected to be used to produce 20 scans a day, for 23 days a month.

If Nanox’s order book is as valid as the company insists, and it already has deals for 5,150 units in place, each system will consequently be bringing in a minimum of $27,048 dollars per year for a minimum total revenue of $139m. If the systems are used 20 times a day as Nanox hopes, that means almost $400m in sticky recurring revenues annually. To put that in perspective, one of the market leaders for X-ray imaging systems in 2018 was Siemens Healthineers, which turned over almost $2.8bn across its general radiography, fluoroscopy, mammography, mobile, angiography, and CT imaging divisions.

With an order book that is, on the face of it, this healthy, there have been questions as to why Nanox went public at all, but the listing may be required for this business model to work. The Israeli vendor says that the vast majority of the investment will be sunk into producing the Nanox scanners, and the associated manufacturing capacity. This is necessary because unlike other imaging companies selling systems on a CapEx basis, Nanox will receive nothing for delivering scanners to customers. Revenue is generated later as the systems are used.

This means that the company is effectively fronting the initial cost of the systems, so needs to get as many units installed and being used as quickly as possible to recoup its initial costs. Unlike other vendors, it cannot rely on sales of a first tranche to fund the second and so on, in its new managed service model, it is better to mass produce everything at once.

Open to exposure

There is, however, nothing to stop other, established players from switching to a similar model. This should be of concern to Nanox, after all, Siemens Healthineers or GE Healthcare already have the manufacturing capacity and capital ready to offer products in a similar way.

And of course, Nanox, shouldn’t underestimate the difficulty of disrupting a long-established market. Despite ample funding and solid products, other companies are still struggling to make an impact in other markets. For example, Butterfly Network, a vendor offering an affordable handheld ultrasound solution, has a valuation of over $1 billion and has received more than $350m in funding.

In 2019, the company turned over $28m, enough to make it the market leader in the nascent handheld category, but in a global ultrasound market worth almost $7bn, at present, it is little more than a drop in the ocean.

Nanox hopes that its own new business model would be disruptive by opening up the market to a far greater range of customers than are currently served. A nursing home, for example, might not be able or willing to allocate the cost of a CT machine from a single year’s budget, but spreading that cost as the scanner is used, and particularly if that cost is passed on to patients at a time of use, on-site imaging suddenly becomes a far more feasible proposition.

What’s more, if a company was able to increase its product’s user base there is a strong possibility for upselling additional services, software, and tools. These could be things like AI modules that increase workflow efficiency, or, especially pertinent given the pricing model could allow machines to be installed in new settings that lack on-site expertise, tools that aid clinical decision making.

Beyond that, there is also ample scope for an imaging vendor to entice a customer into its ecosystem with a scanner that has no cost at the point of delivery, before getting it to commit to its own PACS and other IT systems. Being able to fully exploit these new customers relies, in the first instance, on being able to get a foot in the door. That is why an imaging service model could be so beneficial, even if the returns on the scans themselves aren’t especially lucrative.

Features first

While adopting a new business model and securing revenue from add-ons and upselling would help established vendors countenance the price differential Nanox proposes, if we are to take the start-up at its word, addressing its feature set might be another matter entirely.

As well as just providing imaging hardware, Nanox is offering a service that, at face value, is more complete. The Arc automatically uploads all imaging data to its cloud SaaS platform. This platform would initially use AI systems to ‘provide first response and decision assistive information’ before radiologists could provide final diagnoses that could then be shared with hospitals in real-time.

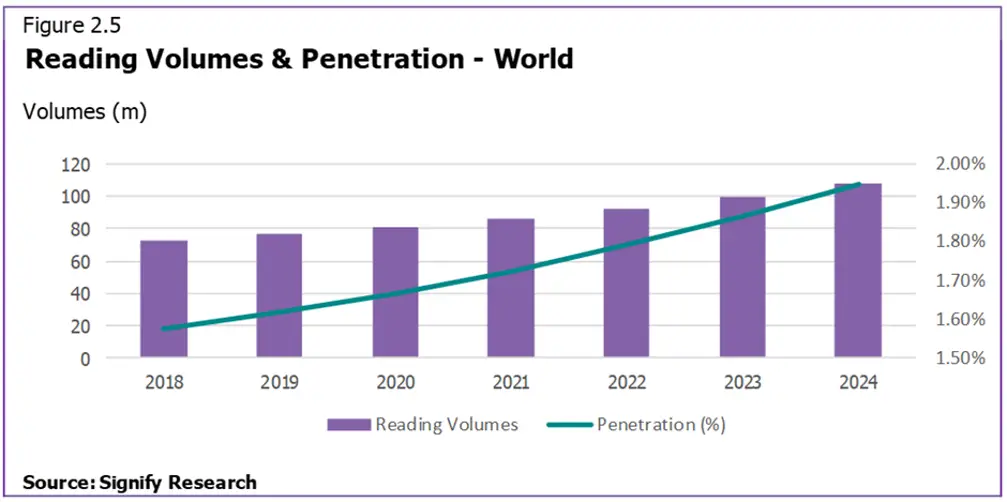

Figure 2: With teleradiology read volumes increasing, it makes sense that the necessary hardware comes baked into the Arc

There is currently limited information available about the exact nature of the so-called Nanox.CLOUD and its integration with the Arc, although several assumptions can be made:

– Firstly, although built-in connectivity is being touted as a feature with clinical benefits, its inclusion is as likely to be a necessity as a design choice, given that Nanox presumably needs to be able to communicate with the systems in order to find out scan volumes and bill accordingly. Or, more drastically, render the system inoperable if people don’t keep up with payments.

– Another assumption that can be made is that the full suite of tools wouldn’t be included in the basic pay-per-scan fee. Signify’s Teleradiology World – 2020 report found that in 2020, the average revenue per read for a teleradiology platform is, in North America for example, $24.40. As such, teleradiology services would only be able to be offered at an additional cost, creating another revenue stream for Nanox.

– Another sticking point could also be Nanox’s promise to enable the integration of its cloud into existing medical systems, via APIs. While well and good in theory, the competitiveness, complexity, and proprietary nature of many medical imaging workflows, combined with the fact that many vendors have absolutely no incentive to make integration easy for the newcomer, mean that in practice, it is likely to either be a prohibitively expensive, or frustratingly limited offering. This is one area where established vendors, which already offer comprehensive medical imaging packages, have a distinct advantage.

Back down to Earth

The short positions promoted by commentators including Citron Research and Muddy Waters Research postulate that the Nanox.ARC scanner isn’t real. There are some legitimate questions, but running through their papers is also an attitude that Nanox’s claims are simply implausible, whether that is because it has an R&D budget a fraction of the size of GE, or because anonymous radiologists unrelated to the company haven’t seen anything like it before.

It is worth remembering, though, that these short sellers will benefit financially if Nanox slumps. Nanox conversely, is obviously financially incentivized to promote its technology and its potential, and it wouldn’t be the first company, to promote the limited fruits of its start-up labor in a flattering light.

As so often happens in these he said, she said situations, the truth could well lie somewhere between the two extremes. Even in this instance, even if Nanox fails to deliver on some of its more impressive promises, the fact is, it has suggested bringing a whole new customer base into play and laid out a strategy for selling to them.

With that being the case, for a big vendor the issue of whether Nanox is legitimate almost becomes moot, their focus should be what these other customers require, how to get these customers into their product ecosystems, and what add-on products, and additional services they can feasibly sell them at a later date.

If nothing else, the entire Nanox furor shows that to achieve growth in mature markets, a vendor’s innovation needs to extend beyond its products.

About Alan Stoddart

Alan Stoddart is the Editor at Signify Research, a UK-based market research firm focusing on health IT, digital health, and medical imaging. Alan joined Signify Research in 2020, using his editorial expertise to lead on the company’s insight and analysis services.