The European primary care telehealth market has been transformed since the outbreak of COVID-19 more than 15 months ago. But which countries have developed an ecosystem that is primed for long-term growth that will bring value and improved processes to both healthcare providers and patients?

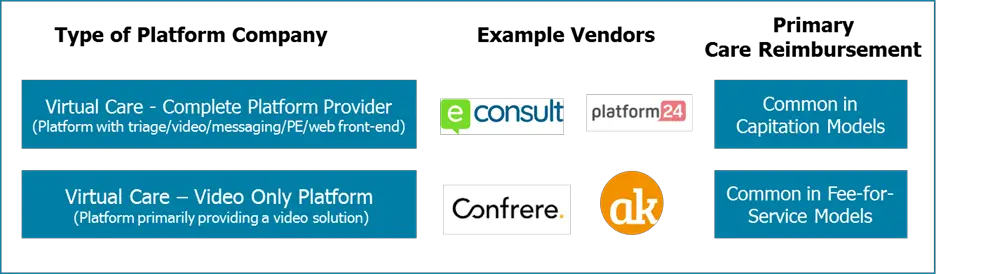

A key starting point is to define the vendors that serve primary care telehealth. There are two types of company that address this market.

– Telehealth Service Providers – These are companies that sell virtual care services that replace the traditional bricks-and-mortar GP or Primary Care Physician (PCP) consultation. Their play is not selling a platform, but a consultation service for private insurance companies, consumers, employees and in some case traditional healthcare providers. Think of companies like Babylon Health, Doctor Care Anywhere, Push Doctor, Dr Morton’s, KRY, Doktor.se and Doktor24.

– Telehealth Platform Vendors – These are vendors that sell a platform for traditional GPs/PCPs that enable these service providers to offer their own virtual care services in addition to traditional face-to-face services. Examples vendors include Doctolib, eConsult, Emis Health, CompuGroup Medical, Cegedim, Pharmeon, Confrere, arztkonsultation ak, LIVI and Platform24.

The keen observer will notice some companies fall into both categories but with different brands (e.g. KRY/LIVI, Platform24/Doktor24), we’ll come back to this later…

Platform Vendors

Taking the latter first, telehealth platform vendors have been core in the COVID response. As lockdown was implemented across Europe, GPs/PCPs engaged platform vendors en-masse to rapidly transition to largely virtual service provision. It was not uncommon for telehealth platform vendors to see their customer base (i.e. the number of physicians using their platforms) increase by a factor of ten over the period March 2020 to May 2020, with consultation volumes performed over these vendors’ platforms often increasing even faster.

As well as raw demand, growth was fuelled by the relaxation in local legislation (e.g. virtual care was limited to 10% of practice consultations in Germany prior to the pandemic, but unlimited during the last 15 months) and government funding to support the rollout of solutions (e.g. NHS funding for CCGs in England to digitally enable primary care).

The Complete Digital Front Door

However, the type of platform vendor and solution that has evolved over the last 12 months (and to a large extent prior to this) varies considerably by country and is dependent on how virtual care is being used in a given country.

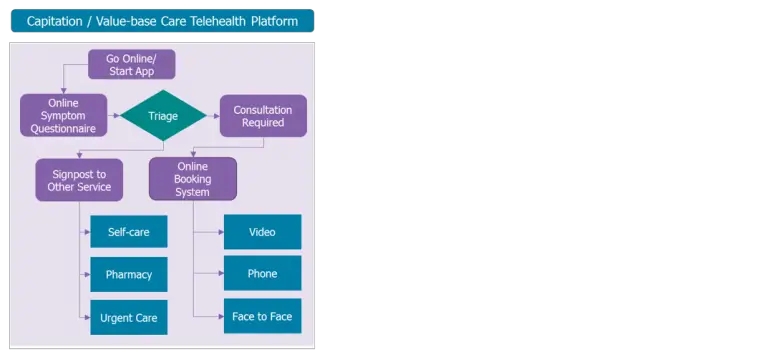

Typically, in countries where primary care reimbursement is more dominated by capitation payment models, demand has been for platforms that don’t just provide video consultations, but also offer tools to support the broader digital strategy of a primary care provider (as described on the diagram on the left).

For this type of solution, virtual care platforms need to offer triage, digital messaging, signposting, patient education content, a digital front-end to a practice and of course video consultation services.

In these examples the demand is for a complete solution that aids the provider in managing capacity digitally as well as offering a digital front door to services.

Typically, solutions of this type demand higher subscription premiums compared to pure video consultation platforms. Providers in capitation-dominated reimbursement countries are not financially driven by consultation volumes and it is in this environment that complex virtual care platform vendors can thrive.

Larger Contracts, Higher Premiums, More Resilient Business Model

Sweden is a prime example of a country where this market environment exists (although fee-for-service still has some part to play). Vendors such as Platform24, Visiba Care, and Doctrin have taken advantage of this, establishing a customer base using full digital triage solutions based on larger contracts with regional procurement agencies and integration with Sweden’s national 1177 digital patient engagement service. Similar is true in the UK where 11 vendors were pre-selected by NHS England to provide virtual care platforms such as those described in the diagram above during the pandemic, and which were sold typically at a regional level to Clinical Commissioning Groups serving many GP practices. Vendors such as eConsult, accuRX, Emis Health, LIVI, Visiba Care, Q doctor, and Silicon Practice have all benefitted.

A key question that has persisted since the outbreak of the pandemic has been to what extent telehealth’s success will endure as restrictions are lifted? Indeed, virtual consultation volumes have dropped off to some extent as this has occurred (albeit volumes are still at levels unrecognisable prior to March 2020). However, vendors with products of this type and serving markets with this reimbursement model are less exposed to these trends. Typically, they follow a per-provider/per-practice pricing model, and as solutions are more integrated into many workflows beyond video consultations, platform demand and revenue are less likely to drop even if virtual consultation volumes plateau or fall.

A Video Only Play

In countries where reimbursement is more dominated by fee-for-service (FFS) primary care models, and those where telehealth’s use was more limited due to pre-pandemic legislative restrictions, telehealth demand has tended to be larger for platforms that are largely focused on addressing only the video consultation requirements of providers.

Primary care providers operating in fee-for-service reimbursement models are financially driven by consultation volumes and have less of a demand for complete digital triage platforms that may drive revenue to other provider types or limit consultations by providing self-help tools.

That’s not to say companies operating in these markets haven’t also enjoyed a huge amount of success over the last 12 months. Vendors that were relatively small before the pandemic, such as Confrere in Norway and arztkonsultation ak in Germany, have been propelled to local leaders in their respective geographies due to the impact of COVID and the ease of workflow integration that their solutions offer.

However, the solutions are not as broad in terms of functionality as those mentioned above. To some extent, these vendor types followed free models of platform provision as market demand ramped up in 2Q20 in order to gain share and are now in the processes of converting their new subscribers to paying customers (most of the time successfully, but not always – some have seen customer volume declines).

They may also be more susceptible as lockdown restrictions are eased and more providers turn their attention back to physical visits. Addressing just the video element and not becoming the effective digital front door of a practice reduces the level of integration into broader workflows. Key to success will be developing relationships with other IT vendors (e.g. EHR vendors) and locking in customers by ensuring solutions become increasingly central to digital processes.

Video as a Platform for Expansion

Product evolution here is typically more focused on a different set of features compared to those operating in a capitation environment. Features such as booking management (BMS), EHR integration, messaging, and digital waiting rooms are where development is focused and less so on features that sign-post to self-help or adjacent healthcare service providers.

Doctolib is a great example of a company that originally operated in a primary care environment (France) where fee-for-service dominates and that has had considerable success partly owing to the explosion in telehealth. Initially positioned as a BMS platform vendor, where it became the dominant offering in France, it has since added virtual care functionality to its portfolio and is now the go-to platform for much of the French population in terms of the first port-of-call when interacting with healthcare services. From this position of strength, it has now expanded both in terms of product (adding EHR functionality for its French primary care customers), geography (expanding into Germany) and vertical (addressing the hospital market via its strategic relationship with acute EHR vendor Maincare). Describing Doctolib as a disruptive vendor would be an understatement and it offers a good model for other digital health vendors and virtual care platform vendors planning their future roadmaps in FFS environments.

Telehealth Service Providers – Friend and Foe

As mentioned at the start of this insight, a key category of primary care telehealth company is the telehealth service provider. COVID has also brought European revenue growth for many of these service providers with UK-based Doctor Care Anywhere having its IPO at the end of 2020 after recording 2020 revenues of £11.5M ($16.3M), up from £4.5M ($6.4M) in 2019, and Babylon Health also announced it is soon to follow suit with its own IPO after recording 2020 revenues of $79M, up from $16M in 2019. Both companies have achieved success via international expansion as well as domestic growth, as have Swedish telehealth service providers KRY/LIVI and Doktor.se.

These service providers typically sell their services to private insurance companies offering their customers’ rapid access to primary care, or to employer groups following a similar model. However, increasingly they’re being used by traditional healthcare providers in Europe such as the NHS to supplement and on some occasions replace traditional GP practices, and in some cases secondary care services too.

Often this isn’t without controversy as local vested interest groups push back on the grounds of these service providers having the ability to cherry-pick low-acuity customers. Indeed in some countries legislative barriers are limiting their success (e.g. first consultations need to be in person). That said these companies do have a clear role to play in national healthcare strategies, in particular where they can provide a supplemental service where capacity or expertise is limited, as is the case with UK-based Dr. Morton’s and its speciality women’s health services.

As was seen in the US several years ago with companies like Teladoc Health, SOC Telemed and American Well, and as alluded to at the start of this insight, several of these service providers have decoupled their in-house platforms from the consultation services in order to address the platform-only market.

This has been seen by KRY/LIVI in terms of its non-Swedish business and to some extent even its domestic Swedish offerings, Doktor24 via its Platform24 brand, and even Babylon Health, although more in markets outside of Europe (e.g. the US). This has been driven to some extent by local market demands (as was the case in Sweden with KRY and Platform24), but also as part of a broader commercial strategy. Many low-acuity telehealth service providers have consistently lost money, despite rapid revenue growth, and expansion into the platform market and hospital market is often one strategy to drive a more profitable business model.

Ingredients for Long-term Success

In summary, there is no one size fits all solution and model for virtual care. However, in order to drive long-term success for vendors, and a long-term solution for providers and healthcare service users, several elements are key. In terms of the regulatory environment, local regulators now need to put in place a clear and permanent vision. COVID resulted in rapid regulatory change, often positioned as temporary. While enabling healthcare provision to continue during lock-down and driving growth for vendors, governments now need to be clear on the long-term policies of how telehealth is regulated and reimbursed. Constantly extending temporary legislation does not help providers, vendors or patients.

In terms of individual vendor success, there are several key points:

– Adapt solutions to reflect local reimbursement structure: Vendors need to adapt their offerings and positioning depending on the key reimbursement drivers in local markets. In markets dominated by capitation models, products that support a broader triage/self-help model will thrive, whereas in FFS-dominated markets this is less important.

– Extend reach beyond primary care: Throughout many European countries, there is a move toward more integrated care provision. Primary care telehealth platform/service companies that adapt to this, enabling their platforms/services to be used in a range of settings beyond primary care, position themselves well to take advantage of this trend and to operate in verticals that could potentially offer a more profitable business model. It will also limit the likelihood of vendor churn in integrated markets where one vendor addresses several providers.

– Embed solutions across a range of workflows: Offering only simple video consultation solutions will leave a vendor more exposed to changes in telehealth regulation, potential post-COVID reductions in virtual care demand, and competitive churn. By developing solutions that address a broader range of a provider’s digital requirements (e.g. BMS, triage, messaging, or patient engagement), vendors will embed themselves into a greater range of provider workflows, discouraging churn and ensuring less exposure to any negative telehealth trends as countries move out of lockdown.

About Alex Green

Alex Green is the Director and Principal Analyst at Signify Research, a UK-based market research firm focusing on health IT, digital health, and medical imaging. Alex is responsible for leading Signify Research’s Digital Health market intelligence portfolio, initially developing its coverage of the patient engagement platforms and portals market.