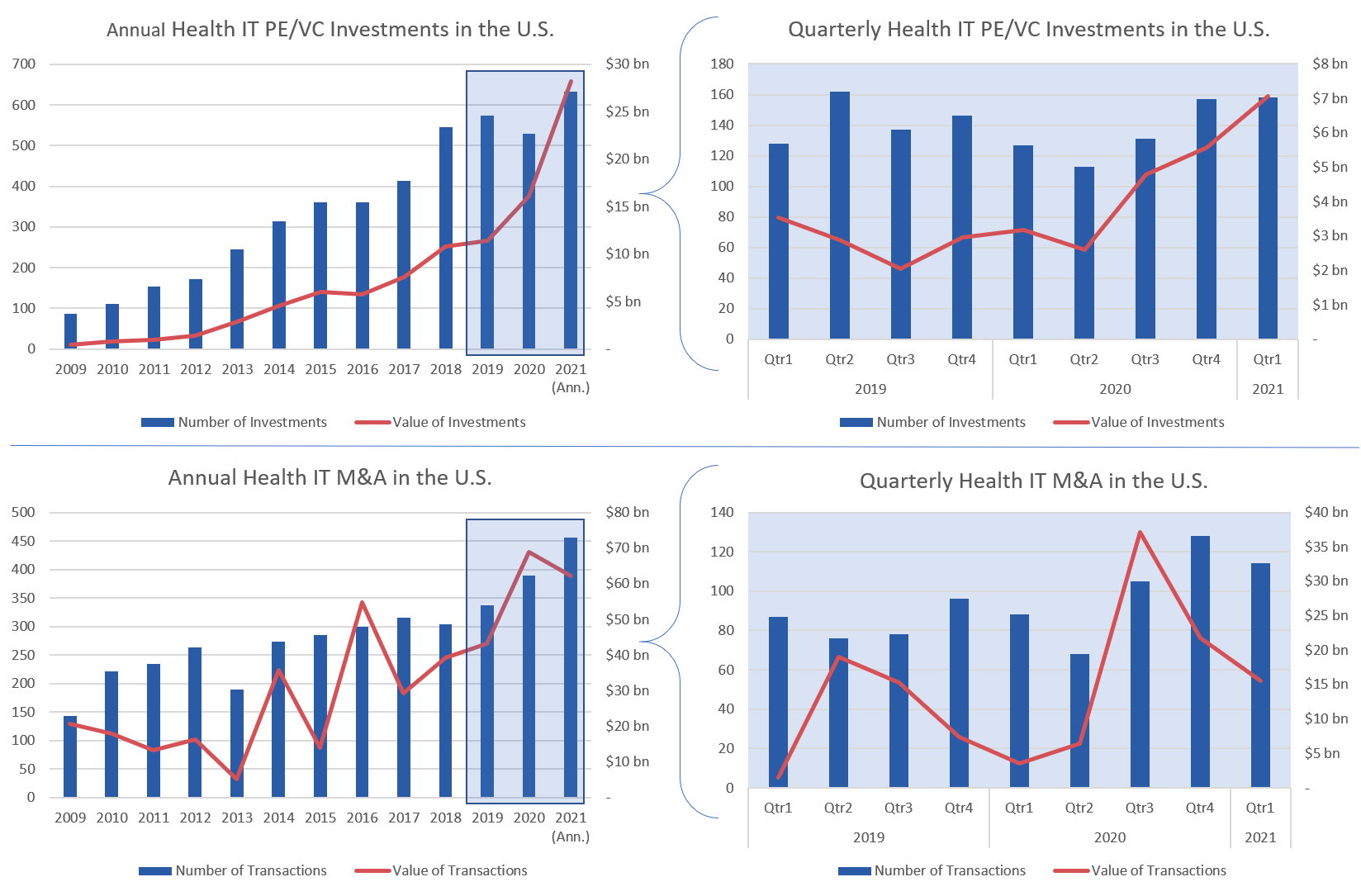

The first quarter of 2021 has been one of investor optimism as the vaccine rollout continues ahead of expectations and economic activity begins to accelerate in response. Within the Health IT industry, the already strong investment and M&A trends seen in 2020 have only accelerated. Over the course of the quarter, we observed $7 billion in private equity and venture capital investment across 158 companies.

By comparison, Q1 of 2020 saw $3.2 billion and 127 investments. Health IT M&A activity has also been strong in the first quarter, with 114 transactions observed compared to just 88 in Q1 of 2020. The gradual loosening of pandemic restrictions and government stimulus both promise to continue to fuel this strong market activity into Q2 and into the future.

Haven disbanded in February. The joint venture between Amazon, Berkshire Hathaway, and JP Morgan Chase was founded in 2018 to revolutionize how health insurance was managed and disrupt the healthcare industry. The three founding companies are expected to take lessons from the venture to continue to innovate individually and collaborate informally.

UnitedHealth’s OptumInsight agreed to acquire Change Healthcare for approximately $8 billion and to assume $5 billion of Change Healthcare debt. The combination is expected to help improve clinical decision support at the point of care, reduce administrative waste, and enable transactional connectivity across the healthcare system.

A coalition of Health and Technology Industry leaders announced the Vaccination Credential Initiative (VCI), in an effort to create a trustworthy, verifiable, and universally recognized digital record of vaccination status worldwide to safely enable people to return to work, school, events, and travel.

HHS Protect further solidified itself as the single source of truth for national COVID-19 patient information, hospitalization levels, hospital capacity, critical equipment supplies, and staffing. Alexis C. Madrigal, co-founder of the COVID Tracking Project, penned an enlightening op-ed in The Atlantic voicing strong support for the system emphasizing the improved quality and granularity of data available after the system was put in place.

The HHS announced a synthetic data challenge to further cultivate Synthea, an open-source synthetic patient generator that models the medical histories of synthetic patients. Synthetic patient data promises to facilitate patient-centered outcomes research by increasing the availability of data and complementing the use of real clinical data.

Amazon announced that Amazon Care will be rolled out nationwide over the summer and will open access for other employers to offer the service as a workplace benefit.

Noteworthy Transactions

Noteworthy M&A transactions during the quarter include:

SOC Telemed acquired Access Physicians for $194mm to solidify its acute care telemedicine services.

Net Health acquired Casamba LLC to support post-acute care providers and expand its cross-continuum solutions.

Anthem, Inc. announced it entered into a definitive agreement to acquire myNEXUS®, a comprehensive home-based nursing management company for payors.

Appriss Health acquired PatientPing to create the largest care coordination network in the U.S.

Omega Healthcare acquired himagine Solutions, provider of medical coding and registry services.

Clinical Navigation platform, Grand Rounds, merged with telehealth provider Doctor On Demand to form a multibillion-dollar digital health company.

Tegria acquired Cumberland, a leading healthcare consulting and services firm for payers and providers, to provide new and enhanced offerings for healthcare providers and payers.

PatientPoint acquired Outcome Health to create a platform offering tech-enabled patient engagement solutions that create more effective doctor-patient interactions across the entire patient care journey.

MDLive announced it has entered into a definitive agreement to be acquired by Cigna’s Evernorth to provide the payer’s healthcare services subsidiary with an integrated virtual care offering.

WEX signed a definitive agreement to acquire certain HSA assets of HealthcareBank for $250mm to better capture the economics from the assets.

MultiPlan Corporation completed the acquisition of Discovery Health Partners, an analytics and technology company offering healthcare revenue and payment integrity services. With the acquisition, MultiPlan strengthens its service offering in the payment integrity market with new and complementary services to help its payor customers manage the overall cost of care and improve their competitiveness.

Boston Scientific announced an agreement to acquire Preventice Solutions, Inc. to expand rhythm management diagnostics portfolio and capabilities.

Philips announced an agreement to acquire provider of medical device integration and data technologies, Capsule Technologies, for $365 million to transform the delivery of healthcare along the health continuum with integrated solutions.

Accolade announced an agreement to acquire telemedicine start-up 2nd.MD for $460 million.

OptumInsight and Change Healthcare have agreed to merge. Change Healthcare will join with OptumInsight to provide software and data analytics, technology-enabled services and research, advisory, and revenue cycle management offerings to help make health care work better for everyone.

Noteworthy Buyout transactions during the quarter include:

Data and software company serving EMS, fire departments, hospitals and state EMS/trauma offices, ESO received a strategic investment from Vista Equity Partners.

iN2L, provider of person-centered digital engagement solutions for the senior living market, announced a strategic growth investment from Vista Equity Partners.

Omega Healthcare Investors acquired senior living technology provider Connected Living.

Carrick Capital acquired a majority stake in kidney dialysis-focused company Renalogic.

AUA Private Equity recaped bistroMD, a meal delivery subscription service for weight loss and long-term weight management.

LLR Partners invested in Azalea Health, a rapidly growing provider of cloud-based electronic health record and patient engagement solutions for inpatient and outpatient community health organizations.

Patient payment and end-to-end patient financial engagement technologies, Millennia, announced a growth investment by Pamlico Capital And Eir Partners.

CVC Capital Partners became a majority stakeholder in System C, the UK supplier of health and social care software and services.

Healthcare revenue cycle management company serving the ASC market, National Medical, announced it entered into a strategic partnership with Aquiline Capital Partners.

CloudWave, a cloud and managed services provider for healthcare, received a majority investment from Abry Partners.

Prescient Healthcare Group, a global product strategy advisory firm serving the pharmaceutical and biotech industries, received an investment from Bridgepoint Development Capital

Technology-enabled hub services platform facilitating patient access to specialty medications, CareMetx, announced a strategic growth partnership with General Atlantic and The Vistria Group.

Brentwood Associates recapitalized MedBridge, provider of patient engagement and clinical education solutions for healthcare professionals.

Lightbeam Health Solutions received a strategic investment from Primus Capital.

Noteworthy Investments during the month include:

HR and benefits software solution, Ease, raised $41M Series C Financing to deliver on its Mission to Simplify and Enhance HR and Benefits Administration.

Rightway raised $100 million at a $1.1 billion valuation to continue revolutionizing care navigation and pharmacy benefits.

Cityblock Health raised $192 Million in Series C extension funding to accelerate deployment of its value-based care model nationwide.

Ginger, an on-demand mental health company, announced a $100 Million Series E financing from Blackstone to continue expanding access to value-based mental healthcare globally.

Ro, a vertically integrated primary care telemedicine platform, raised $500 Million in Series D Funding with the intent to expand its pharmacy distribution network, enhance its proprietary EMR, and broaden into additional treatment areas.

Komodo Health secures $220 million in funding led by Tiger Global Management to accelerate investment in its enterprise technology platform designed to help the world’s leading life sciences companies, health plans, and patient advocacy groups improve patient engagement and address unmet patient needs.

Evidation Health, a health data analytics company, raised a $153 million Series E led by OMERS growth equity and Kaiser Permanente with plans to expand its virtual health capabilities.

Unite Us announced a $150 million Series C financing led by ICONIQ Growth at a valuation of $1.6 billion. The company will use the funds to continue its mission of connecting social care and medical care.

Strive Health raised a $140 million Series B led by CapitalG to address $410 billion of unmanaged kidney disease spend.

insitro, a developer of artificial intelligence for drug discovery, raised a $400 million Series C round led by Canada Pension Plan.

BrightInsight raised $101 million in Series C funding led by General Catalyst to expand its team and further differentiate its development platform for regulated software, connected devices, drugs, and digital therapeutics.

Cedar closes a $200 million Series D to continue meeting the accelerating demand for its patient financial engagement platform.

WeDoctor, a telemedicine provider based in Hangzhou, raised $400 million in a pre-IPO round valued at $6.8 billion with investors such as Sequoia Capital China and Millennium Management participating.

BetterUp, an online provider of personalized coaching and content, raised a $125 million Series D led by ICONIQ Growth at a valuation of $1.73 billion to invest in additional innovative products.

Innovaccer raised a $105 million Series D at a $1.3 Billion Valuation, launching Innovaccer Health Cloud, a platform-as-a-service to enable customers and partners to build interoperable applications that improve patient engagement and operational performance.

Health insurtech company Sidecar Health raised $125 million in its Series C at a valuation of $1 billion. The funds will be used to launch a new Affordable Care Act offering for federal and state exchanges.

Valo, a company working to transform the drug discovery and development process with data, raised $190 million in Series B financing.

Noteworthy IPOs/ SPACs during the quarter include:

Continuous glucose monitoring provider, Movano Inc., completed its IPO, raising $42.5 million.

Medical mobility and transportaiton provider, Ambulnz, announced plans to go public via reverse merger with Motion Acquisition Corp., valuing the Company at $1.1 billion.

Medical network provider, Doximity, confidentially filed for an IPO.

Alignment Healthcare, a provider of privatized Medicare benefits for seniors, completed its IPO, raising $490 million at a valuation of $3.37 billion.

Connected nursery ecosystem, Owlet Baby Care, announced plans to go public via reverse merger with Sandbridge Acquisition.

Sema4, a disruptive AI-driven genomic & clinical data platform company, announced plans for a reverse merger with SPAC CM Life Sciences

23andMe to Merge with Virgin Group’s VG Acquisition Corp. to Become Publicly-Traded Company Set to Revolutionize Personalized Healthcare and Therapeutic Development through Human Genetics

Sharecare and Falcon Capital Acquisition Corp. Reach Agreement to Combine, Creating Publicly Traded Digital Health Company

Signify Health Files Registration Statement for Proposed Initial Public Offering

LumiraDx, a Next-Generation Point of Care Diagnostics Testing Company to List on Nasdaq via Merger with CA Healthcare Acquisition Corp

Hudson Executive Investment Corp had entered into a definitive merger agreement with Talkspace

About Healthcare Growth Partners (HGP)

Healthcare Growth Partners (HGP) is a Houston, TX-based Investment Banking & Strategic Advisory firm exclusively focused on the transformational Health IT market. The firm provides Sell-Side Advisory, Buy-Side Advisory, Capital Advisory, and Pre-Transaction Growth Strategy services, functioning as the exclusive investment banking advisor to over 100 health IT transactions representing over $2 billion in value since 2007.