Much of the focus in the ultrasound market in the last few years has been on the handheld market. This is justified, considering its role in the response to the COVID-19 pandemic and the spate of innovation in the sector, both in terms of new product releases and partnerships. As a result, there is less mention of the other ultrasound product segments, especially the compact market. However, the compact market has also been active, with the release of Fujifilm SonoSite’s SonoSite LX in February 2022 the latest in a slew of new compact ultrasound releases following the launch of Mindray’s TE7 Max in October 2021 and the release of the SonoSite PX by Fujifilm SonoSite, Venue Fit by GE Healthcare and the SONIMAGE HS2 by Konica Minolta in the last 12-18 months. This begs the question: what role do compact systems have in the ever-changing ultrasound market? What risk does the growing handheld market pose? And what does the future hold for the compact ultrasound market?

Bigger can be better for vendors

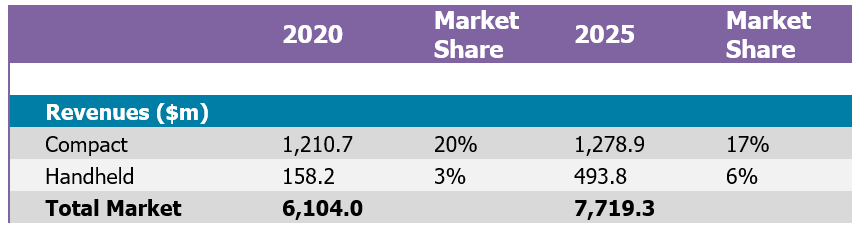

The handheld market is forecast to be the fastest-growing product segment, with our Ultrasound World Market 2021 Report predicting a 2020 to 2025 CAGR of 26%. The lower price of handhelds compared to compact systems means they are attractive to new users who are not experienced in ultrasound. They are also desirable for existing ultrasound customers who want even more portability with their ultrasound systems. The faster pace of AI innovation in handheld systems, with capabilities such as image capture guidance, anatomy detection and image analysis now coming to market, also help make these products more useable for clinicians who are less familiar with ultrasound. This ultimately means that handhelds are, to some extent, taking share from the compact market. However, the handheld market still only accounted for 3% of the global ultrasound market revenues in 2020 (Table 1). This is a mere slice compared to the 20% held by the compact market. Even though the handheld market is forecast to be the fastest-growing product type, driven by its role as an adjunct to existing ultrasound users and penetration into new markets, it will still only account for 6% of the total market in 2025. This is still nearly 3 times less than the 16% market share forecast for the compact market in that year.

Table 1 – Compact vs Handheld Market Share

The disparity between the revenue to be gained from compact versus handheld systems is even bigger when considering the aftersales of transducers. Whereas handheld systems are usually sold with a single or dual-probe configuration, with no aftersales of probes, compact ultrasound systems are typically sold with 2 or 3 transducers, with the prospect of additional or replacement probe sales in the future. This comes at an additional cost and pushes up the average selling price vendors can achieve. The SonoSite LX is a prime example of this. Alongside the launch of the new system, it launched a new T8-3 transoesophageal transducer, designed to be used with the SonoSite LX and SonoSite PX. The addition of a high value, specialist probe not only increases the initial price of the system but customers may need to purchase another T8-3 before replacing the SonoSite LX. Our report Ultrasound Transducers & Catheters – World Market – 2021 Edition shows the average selling price (ASP) for transducers to be around $3,500 (heavily discounted due to bulk sales of transducers with ultrasound systems). This means transducers can easily add $7-$10k on top of the price of a compact ultrasound system, potentially more depending on the transducer types. Furthermore, there are typically more opportunities to upsell services and software with compact systems than with handhelds.

Another disparity is the initial price of compact systems compared to handhelds. Handheld systems had an average selling price (ASP) of $3,900 in 2020, which is forecast to drop to $3,600 by 2025. This is substantially less than the $18,600 ASP of compact systems in 2020, which is forecast to increase to $18,900 by 2025. It means that for each compact system sold, there need to be nearly 5 handheld systems sold to generate the same amount of revenue. It is even more when considering that mid-range and premium compact systems are sold for upwards of $30,000.

From war to wards

When forecasting the future of the compact ultrasound market, it can be helpful to reflect on its origins. Over 20 years ago, the USA Department of Defence awarded a DARPA grant to ATL Ultrasound (former parent company to SonoSite) with the objective of creating an ultrasound system able to be used in war at a trauma patient’s side. It resulted in the world’s first POC, and first compact, ultrasound system, the SonoSite 180. Since the introduction of the SonoSite 180, the continued market education of the virtues of point of care ultrasound, initially led by Fujifilm SonoSite with many of the established ultrasound vendors following suit, has enabled compact ultrasound to evolve from its war trench origins to a product utilized by healthcare professionals across multiple care specialties and care settings to improve the patient experience.

The use of compact systems has been predominantly within the POC market, with cart systems mainly used in the traditional ultrasound markets; radiology, cardiology and women’s health. However, the use of compact systems has expanded into these traditional clinical applications. Our latest report on the ultrasound equipment market shows that around half of compact systems sold in 2020 were to the POC market, with over a third to the traditional markets and the remainder to specialty markets, such as veterinary.

As well as an expansion in the market applications for compact systems over the years, there has also been strong development of the technical capabilities as well. Whereas image quality used to be more limited in older compact systems, this is becoming less and less of an issue. So much so that the latest compact systems offer comparable, and in some cases better, image quality than cart systems of an equivalent price. Whilst some cart systems are designed to be more portable, such as the Resona I9 from Mindray, carts do not compare to the portability offered by compact systems. What is crucial when comparing compact systems to carts, is that whilst the portability of the ultrasound system will be favorable for some customers, the image quality must not be compromised.

The Signify View

In the ultrasound market today, press interest is currently geared toward the handheld market, which is awash with new vendors, innovation and development, or feature-rich premium cart systems, the most lucrative segment of the market for vendors. As such, the compact market can appear at times to get lost in the weeds. However, this is far from the case. Compact systems are also evolving, benefitting from advancements in image quality, AI capabilities and advanced features trickling down from cart systems.

Compact systems are more expensive and less portable than handheld scanners, but provide advanced technical capabilities, as well as other advantages such as increased screen size, extended scanning times and the ability to do scans with one hand more easily than with handhelds. Since the introduction of compact ultrasound systems, the cart and compact markets have developed and evolved. Whilst compact systems are now used in traditional clinical applications, they are typically not directly competing with cart systems and are predominantly for customers looking for a more portable system to complement their cart system. As the ultrasound market develops and expands, vendors are finding distinct market segments for their cart and compact systems. The same is generally true for compact and handheld systems. Whilst the handheld market will take some market share from compacts, particularly the low-end compact market, the differences between them mean that even if they are used within the same clinical applications, such as in emergency medicine and critical care, they will not necessarily be in direct competition with each other. As handheld systems are used in new markets and by less experienced users, this will further drive the distinctions between the uses of handheld and compact systems. This will be further supported by the increasingly available AI features and tele-ultrasound platforms for handheld scanners.

For customers who want a portable ultrasound system that doesn’t take up too much space, has a big screen size and good technical capabilities, they’ll look at one place – compact ultrasound systems.

Much of the focus in the ultrasound market in the last few years has been on the handheld market. This is justified, considering its role in the response to the COVID-19 pandemic and the spate of innovation in the sector, both in terms of new product releases and partnerships. As a result, there is less mention of the other ultrasound product segments, especially the compact market. However, the compact market has also been active, with the release of Fujifilm SonoSite’s SonoSite LX in February 2022 the latest in a slew of new compact ultrasound releases following the launch of Mindray’s TE7 Max in October 2021 and the release of the SonoSite PX by Fujifilm SonoSite, Venue Fit by GE Healthcare and the SONIMAGE HS2 by Konica Minolta in the last 12-18 months. This begs the question: what role do compact systems have in the ever-changing ultrasound market? What risk does the growing handheld market pose? And what does the future hold for the compact ultrasound market?

Bigger can be better for vendors

The handheld market is forecast to be the fastest-growing product segment, with our Ultrasound World Market 2021 Report predicting a 2020 to 2025 CAGR of 26%. The lower price of handhelds compared to compact systems means they are attractive to new users who are not experienced in ultrasound. They are also desirable for existing ultrasound customers who want even more portability with their ultrasound systems. The faster pace of AI innovation in handheld systems, with capabilities such as image capture guidance, anatomy detection and image analysis now coming to market, also help make these products more useable for clinicians who are less familiar with ultrasound. This ultimately means that handhelds are, to some extent, taking share from the compact market. However, the handheld market still only accounted for 3% of the global ultrasound market revenues in 2020 (Table 1). This is a mere slice compared to the 20% held by the compact market. Even though the handheld market is forecast to be the fastest-growing product type, driven by its role as an adjunct to existing ultrasound users and penetration into new markets, it will still only account for 6% of the total market in 2025. This is still nearly 3 times less than the 16% market share forecast for the compact market in that year.

The disparity between the revenue to be gained from compact versus handheld systems is even bigger when considering the aftersales of transducers. Whereas handheld systems are usually sold with a single or dual-probe configuration, with no aftersales of probes, compact ultrasound systems are typically sold with 2 or 3 transducers, with the prospect of additional or replacement probe sales in the future. This comes at an additional cost and pushes up the average selling price vendors can achieve. The SonoSite LX is a prime example of this. Alongside the launch of the new system, it launched a new T8-3 transoesophageal transducer, designed to be used with the SonoSite LX and SonoSite PX. The addition of a high value, specialist probe not only increases the initial price of the system but customers may need to purchase another T8-3 before replacing the SonoSite LX. Our report Ultrasound Transducers & Catheters – World Market – 2021 Edition shows the average selling price (ASP) for transducers to be around $3,500 (heavily discounted due to bulk sales of transducers with ultrasound systems). This means transducers can easily add $7-$10k on top of the price of a compact ultrasound system, potentially more depending on the transducer types. Furthermore, there are typically more opportunities to upsell services and software with compact systems than with handhelds.

Another disparity is the initial price of compact systems compared to handhelds. Handheld systems had an average selling price (ASP) of $3,900 in 2020, which is forecast to drop to $3,600 by 2025. This is substantially less than the $18,600 ASP of compact systems in 2020, which is forecast to increase to $18,900 by 2025. It means that for each compact systems sold, there need to be nearly 5 handheld systems sold to generate the same amount of revenue. It is even more when considering that mid-range and premium compact systems are sold for upwards of $30,000.

From war to wards

When forecasting the future of the compact ultrasound market, it can be helpful to reflect on its origins. Over 20 years ago, the USA Department of Defence awarded a DARPA grant to ATL Ultrasound (former parent company to SonoSite) with the objective of creating an ultrasound system able to be used in war at a trauma patient’s side. It resulted in the world’s first POC, and first compact, ultrasound system, the SonoSite 180. Since the introduction of the SonoSite 180, the continued market education of the virtues of point of care ultrasound, initially led by Fujifilm SonoSite with many of the established ultrasound vendors following suit, has enabled compact ultrasound to evolve from its war trench origins to a product utilized by healthcare professionals across multiple care specialties and care settings to improve the patient experience.

The use of compact systems has been predominantly within the POC market, with cart systems mainly used in the traditional ultrasound markets; radiology, cardiology and women’s health. However, the use of compact systems has expanded into these traditional clinical applications. Our latest report on the ultrasound equipment market shows that around half of compact systems sold in 2020 were to the POC market, with over a third to the traditional markets and the remainder to specialty markets, such as veterinary.

As well as an expansion in the market applications for compact systems over the years, there has also been strong development of the technical capabilities as well. Whereas image quality used to be more limited in older compact systems, this is becoming less and less of an issue. So much so that the latest compact systems offer comparable, and in some cases better, image quality than cart systems of an equivalent price. Whilst some cart systems are designed to be more portable, such as the Resona I9 from Mindray, carts do not compare to the portability offered by compact systems. What is crucial when comparing compact systems to carts, is that whilst the portability of the ultrasound system will be favorable for some customers, the image quality must not be compromised.

The Signify View

In the ultrasound market today, press interest is currently geared toward the handheld market, which is awash with new vendors, innovation and development, or feature-rich premium cart systems, the most lucrative segment of the market for vendors. As such, the compact market can appear at times to get lost in the weeds. However, this is far from the case. Compact systems are also evolving, benefitting from advancements in image quality, AI capabilities and advanced features trickling down from cart systems.

Compact systems are more expensive and less portable than handheld scanners, but provide advanced technical capabilities, as well as other advantages such as increased screen size, extended scanning times and the ability to do scans with one hand more easily than with handhelds. Since the introduction of compact ultrasound systems, the cart and compact markets have developed and evolved. Whilst compact systems are now used in traditional clinical applications, they are typically not directly competing with cart systems and are predominantly for customers looking for a more portable system to complement their cart system. As the ultrasound market develops and expands, vendors are finding distinct market segments for their cart and compact systems. The same is generally true for compact and handheld systems. Whilst the handheld market will take some market share from compacts, particularly the low-end compact market, the differences between them mean that even if they are used within the same clinical applications, such as in emergency medicine and critical care, they will not necessarily be in direct competition with each other. As handheld systems are used in new markets and by less experienced users, this will further drive the distinctions between the uses of handheld and compact systems. This will be further supported by the increasingly available AI features and tele-ultrasound platforms for handheld scanners.

For customers who want a portable ultrasound system that doesn’t take up too much space, has a big screen size and good technical capabilities, they’ll look at one place – compact ultrasound systems.

About Mustafa Hassan

Mustafa joined Signify Research in 2020 as part of the Medical Imaging team which covers areas such as ultrasound, general radiography and machine learning in medical imaging. Prior to that he obtained a PhD in Pharmacy and Physiology from the University of Kent and has three years of post-doctoral experience working on optimising healthcare for genetic Cardiac diseases.