Amid a strategic review that could end in a merger or sale, Enhabit Inc. (NYSE: EHAB) leaders are happy with the company’s progress, specifically on the labor and clinical outcome fronts.

Enhabit CEO Barb Jacobsmeyer refrained from diving into much detail on the strategic review, but did say that “discussions with interested parties are ongoing.”

She did get into third-quarter hiring numbers, however. The company hired 166 net new nurses — on top of the 200 it hired in Q2 — and expects to eliminate all contract labor in its home health segment by the end of the year.

“Our home health team continues to do a great job managing productivity and optimization of our clinical staff,” Enhabit CEO Barb Jacobsmeyer said during the company’s third-quarter earnings call Wednesday. “Our cost per visit increased 1.1% year over year. Improved nursing productivity and optimization offset the impact of merit and market increases for clinical staff.”

The Dallas-based Enhabit has 255 home health locations and 108 hospice locations across 34 states.

Encompass Health Corporation (NYSE: EHC) spun off Enhabit into its own public company in June of last year. Since then, it has struggled, mainly due to staffing woes and Medicare Advantage (MA) penetration.

Enhabit also reported positive developments on the MA front Wednesday.

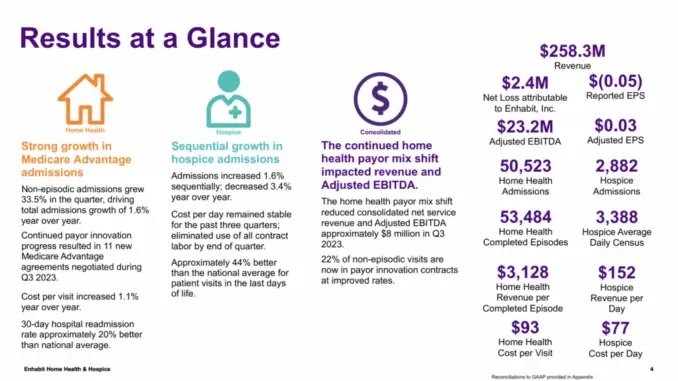

Non-episodic Medicare Advantage admissions grew by 33.5% in the quarter, driving total admissions growth of 1.6% year over year.

Enhabit also agreed to 11 new MA contracts in the quarter.

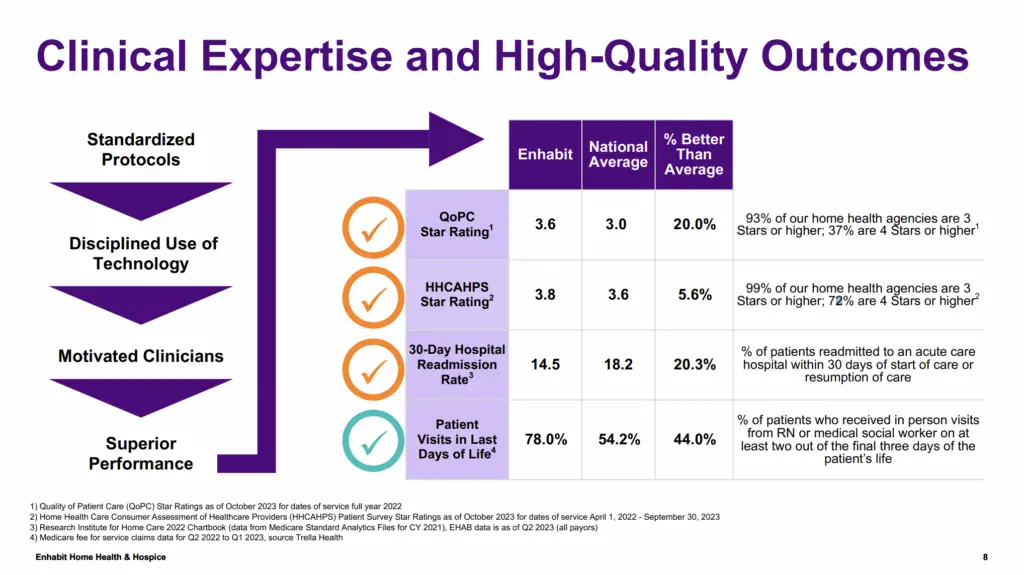

“The strongest value proposition in our negotiations with payers continues to be our low 30-day hospital readmission rate, which is 20% better than the national average,” Jacobsmeyer said. “Our payer innovation team has continued to succeed in demonstrating this value proposition to Medicare Advantage payers. Since the inception of the payer innovation team last summer, we have successfully negotiated 48 new agreements — two-thirds of which are episodic rates.”

Enhabit posted a 14.5% hospital readmission rate, well below the national average of 18.2%.

“We are confident in our ability to make continued improvement in Medicare Advantage pricing and in the shift of our MA admissions to these improved payers,” Jacobsmeyer said. “Some payers are now recognizing the variation of quality results within the industry and are willing to pay for access to high-quality providers like Enhabit.”

Despite some of the positive gains made, the “erosion” of Enhabit’s Medicare fee-for-service business played a large role in the company’s overall performance in the quarter.

“While we are making significant progress demonstrating our value proposition to payers as we negotiate new agreements with improved rates in our successfully shifting Medicare Advantage volume into our payer innovation agreement, the revenue and EBITDA cut from this volume shift has not been enough to overcome the financial impact from the erosion of Medicare fee-for-service volume,” Enhabit CFO Crissy Carlisle said.

Final rule, strategic review update

Like many home health leaders, Jacobsmeyer was disappointed when the U.S. Centers for Medicare & Medicaid Services (CMS) released its CY 2024 final payment rule last week.

The rule came with an estimated aggregate increase to 2024 home health payments of 0.8%, or $140 million, compared to 2023 aggregate payments. It also came with more permanent cuts, however.

“The continued march of these cuts, where the home health community does not know what to expect from Medicare year after year, is not helpful in creating a stable home health landscape,” Jacobsmeyer said. “In fact, it is detrimental to larger policy goals of providing equitable, high-quality health care to seniors in their home. While this final rule means we will be receiving less of a cut than under what was proposed, it does not restore home health reimbursement to where it should be.”

Despite some of the angst that comes with CMS’ cut, Enhabit believes it will remain competitive from a labor standpoint and will be able to manage its resources efficiently to meet the needs of its patients and partners.

Carlisle again clarified that Enhabit entered into a limited waiver agreement with Wells Fargo Bank (NYSE: WFC) earlier this year only out of an abundance of caution.

“As you can see from our financial performance and Q3 leverage position, the waiver we proactively obtained was ultimately not needed,” Carlisle said. “Over the last few weeks, we continue to work with our bank group to amend our credit agreement to provide additional cushion to the financial covenants. With cash on hand of approximately $30 million, and $40 million of availability under our revolver, we believe we have adequate liquidity to support our operations, including our de novo strategy.”

Overall, Enhabit’s net service revenue checked in at $258.3 million, a 2.8% year-over-year decrease.

The company’s home health net revenue for Q3 was $210.9 million, a 2.5% decrease compared to $216.3 million during the same period last year.

The post Enhabit Touts Improved Labor Numbers, New MA Contracts Amid Strategic Review appeared first on Home Health Care News.