Managing a business comes with many responsibilities, including efficient billing management. It is the most crucial task for operating any kind of enterprise. So, it’s essential to upgrade your payment system with changing times. However, some businesses hesitate to adopt new technologies, like payment plan software.

They fear it may make things more complicated. But modern payment plan management software like Denefits makes it easier than ever! It is an excellent way to take your business to the next level.

Here’s an overview of what you will learn in this blog:

- What is Denefits payment plan software?

- Can offering payment plans using Denefits help my business grow?

- How do I offer payment plans with Denefits?

- Who can use Denefits?

- Why should I choose Denefits?

What Is Denefits Payment Plan Software?

Denefits is easy-to-integrate software that provides an all-in-one solution for payment plans. It automates the process of making and managing contracts and receiving payments.

It helps create custom payment plans that suit your customers’ needs. For any customer who can’t pay in one go, you can offer them this alternative.

This way, they can immediately access your services while you receive monthly payments. It eases the financial burden of your customers while you earn recurring revenue. So, it helps create a win-win situation for your business and customers.

You can sign up for free to get started!

Can Offering Payment Plans Using Denefits Help My Business Grow?

Here are some key reasons why Denefits can benefit your business:

Increase Sales and Revenue

Offering payment plans encourages customers to make more purchases, boosting your revenue. Therefore, by accommodating customers’ financial needs, you can close more sales.

Reduce Cash Flow Problems

Cash flow problems can occur when businesses struggle to recover pending/overdue payments. However, payment plans ensure a steady income stream, reducing cash flow fluctuations. Hence, you can invest more in your business’s growth.

Elevate Customer Experience

Customers appreciate the flexibility and convenience of payment plans. They ease the financial barriers that prevent customers from getting the products/services they need. It leads to happier and more satisfied customers, improving the overall experience.

Build a Loyal Customer Base

Offering payment plans helps bridge the gap between providers and customers. It leads the way to building long-term relationships, trust, and loyalty. Hence, it’s more likely to bring you repeat business and referrals.

Streamline Administrative Tasks

Denefits simplifies payment plan management with its user-friendly interface. You can track payments, access transaction data, and see growth data. As a result, it can save you a lot of administrative time and effort.

How Do I Offer Payment Plans with Denefits?

Integrating Denefits into your existing system is as easy as it gets. This software can handle most of the work.

All you need to do is follow these simple steps to get started:

1. Sign-up and Onboarding

You first need to create an account with Denefits. Just follow the on-screen prompts and provide all the related information.

Denefits has a comprehensive verification process, so you may also need to upload a few documentation proofs.

2. Setting Up Your Business Profile

You need to provide some basic business information to complete the setup process. Once done, you can start creating payment plans.

3. Determining Payment Terms

With this payment plan management software, you get more control over the payment terms. For example, you can set different plan durations for every customer. You can also adjust the payment frequency as per your customer’s comfort.

4. Managing Payment Plans

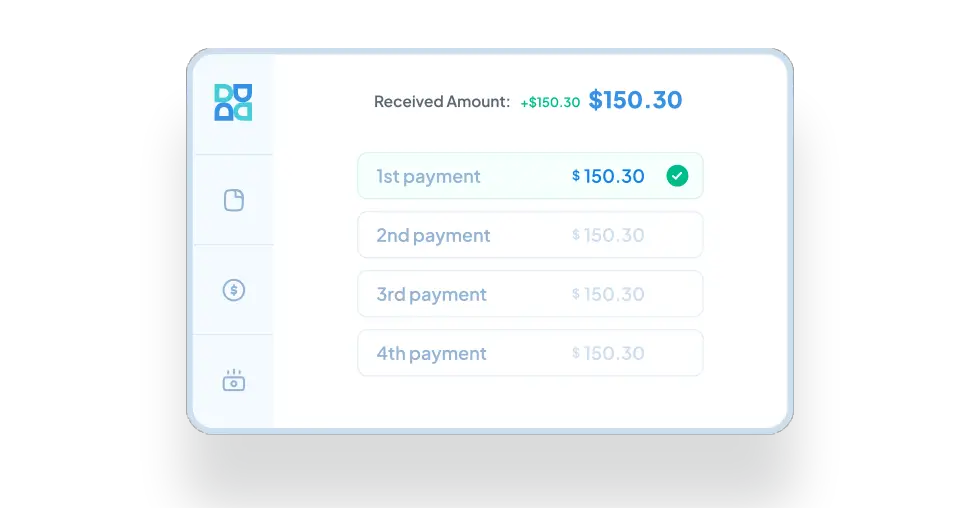

The software tracks and monitors all your payment plans. You can view the status and details of your contracts on the admin dashboard.

5. Automated Payment Reminders

Once you have enrolled a customer in a payment plan, the software will send automated reminders. Hence, you won’t need to follow up with your customers manually.

6. Handling Plan Modifications

With Denefits, you can also modify existing payment plans. Thus, if needed, you can extend contracts or allow early repayments. It means you can reduce/add to the number of payments for a specific customer.

7. Website and API Integration

You can easily integrate Denefits into your existing system or website. Customers can access payment plans directly from your website without wasting time. In simple words, you get customers 24×7.

Who Can Use Denefits?

Denefits is versatile payment plan management software. Its customization options and flexibility make it suitable for various industries. It empowers businesses to enhance accessibility to their services with convenient installment plans.

Therefore, many businesses and healthcare providers across the globe use it to offer affordable services. It caters to several industries, including medical practices, veterinary clinics, cosmetic surgery centers, wellness centers, and many more.

You can book a demo to see whether Denefits is the right payment plan solution for your business.

Why Should I Choose Denefits?

Denefits has various advanced features to streamline your payment process. Hence, you can enjoy a wide range of benefits, such as:

Instant Approvals

It has a simple process for enrolling customers into flexible payment plans. In addition, it offers quick approval within minutes with a 95% approval rate!

No Credit Check

With the “No Credit Check” policy of Denefits, even customers with low credit scores can get approved. Hence, you can support more customers.

Recurring Revenue

Offering flexible installment-based payment plans allows for steady cash flow. The system sends easy payment links to customers so they can make regular payments.

Hence, you can establish positive, ongoing business-customer relationships. It can contribute to better financial stability and business growth.

Protected Payments

Denefits ensures protected payments, so you don’t have to worry about default payments. It empowers businesses to offer payment plans with confidence while ensuring they get their money.

Automated Accounts Receivable

It streamlines the management of accounts receivable. This feature automatically collects your past-due accounts without hampering the business-customer relationship. It sends payment notifications, updates payment status, and ensures smooth bad debt recovery.

The Final Words

Denefits payment plan software simplifies installment-based payments. It allows customers to pay in smaller amounts while keeping track of every plan and collecting payment data. It lets you adjust billing schedules and handle administrative tasks while you work on growing your business.

So, what are you waiting for?

Sign up today to unlock potential growth opportunities for your business!

The post All You Need to Know About Payment Plan Software first appeared on Denefits.