In recent years, contract manufacturers have become an integral part of the overall biopharmaceutical market. This trend is also gaining popularity within the antibody therapeutics market, as developers are increasingly outsourcing their antibody production requirements to contract service providers. This can be attributed to the fact that employing such third-party service providers offers various advantages, such as reduction in overall production cost and decrease in time to market. In fact, CMOs engaged in this domain are actively collaborating with other players and expanding their existing capabilities and capacities in order to cater to the overall demand for therapeutic antibodies.

Since the approval of Orthoclone OKT3® in 1986, monoclonal antibodies have become an important part of modern healthcare practices. In fact, several experts consider monoclonal antibodies to be the backbone of the biopharmaceutical industry. It is worth noting that, till date, more than 100 therapeutic monoclonal antibodies have been approved across different geographies. Owing to their high specificity and the favorable safety profile associated with the therapeutic use of such molecules, antibody-based interventions presently constitute the largest class of biologics in the industry. This trend is unlikely to change in the near future as advanced variants, such as bispecific antibodies and antibody fragments-based products, are steadily gaining traction. Further, owing to legacy challenges associated with the development and production of biologics, such as advanced supply chain requirements, outsourcing antibody production operations is a popular trend.

In order to combat the COVID-19 infection, drug developers and researchers are exploring different ways to develop antibody treatments that are more potent and safer to quell the novel coronavirus. It is worth highlighting that, in April 2020, Vir Biotechnology signed a USD 362 million contract manufacturing agreement with Samsung Biologics. Under the terms of the agreement, Samsung Biologics is responsible for large-scale manufacturing of monoclonal antibodies against SARS-CoV-2. Historical and prevalent trends suggest that sponsor companies are likely to continue relying on contract service providers for various aspects of antibody-based product development and manufacturing.

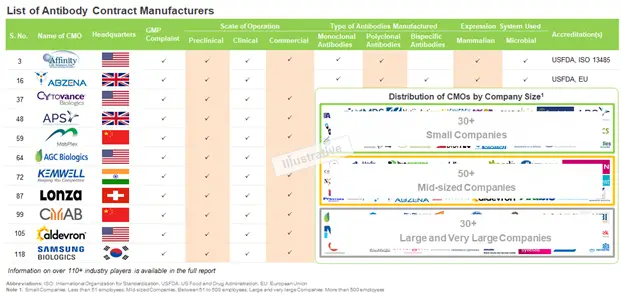

Several companies worldwide claim to possess the required expertise and infrastructure to offer contract manufacturing services for a variety of antibody-based products

Currently, over 100 industry players are actively involved in the antibody production. The antibody contract manufacturing market is presently dominated by the presence of mid-sized companies (between 51 to 500 employees). It is worth mentioning that small (less than 51 employees) and mid-sized firms collectively capture more than 70% of the total dataset.

Among the players that have expertise in antibody contract manufacturing, majority of the antibody contract manufacturers were established during the period 1980 to 2010. In addition, more than 55% have the capabilities to manufacture antibodies at all scales of operation. This indicates that stakeholders are actively striving to adopt the one stop shop model and provide end to end services to customers worldwide. In terms of geography, more than 75% of the contract manufacturers engaged in the production of antibodies are based in North America or Europe.

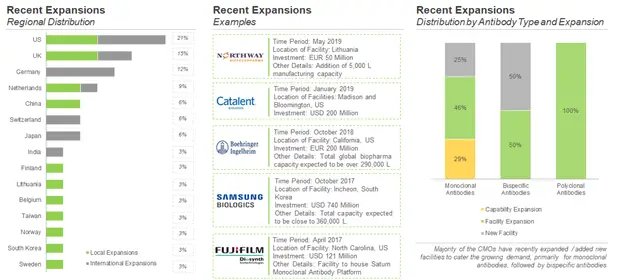

CMOs are actively investing in upgrading existing infrastructure and expanding their respective manufacturing capacities in order to enhance their core competencies

Contract service providers are known to either invest in expanding their existing infrastructure and constructing new facilities or acquiring the facilities of other industry stakeholders in order to accommodate the growth in this respective business. Further, the globalization of healthcare practices and standards has opened up opportunities for such players even in the developing markets of the world. During our research, we identified various expansion initiatives undertaken by antibody contract manufacturers, over the period 2017-2019 (till October).

Majority of the expansion initiatives undertaken by antibody contract manufacturers are facility expansions (53%), followed by instances of new facilities (38%). Within North America, most of the US based companies have expanded their manufacturing facilities outside the US. It is worth noting that antibody CMOs are more focused in expanding their geographical presence (outside their region) in order to strengthen their capabilities and offer their services worldwide.

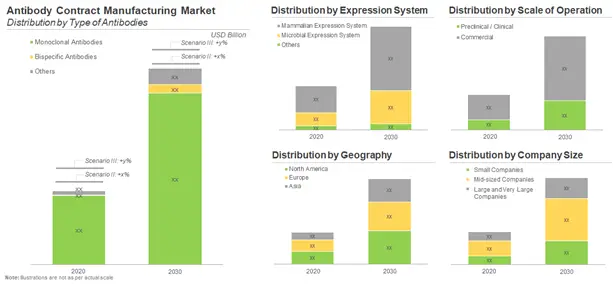

Likely Growth of the Antibody Contract Manufacturing Market

According to our estimates, the antibody contract manufacturing market is expected to witness a CAGR of 12%. Presently, majority of antibody contract manufacturing revenues is generated from projects related to monoclonal antibodies (88%). However, we anticipate that in the coming years, further growth in this market is likely to be driven by bispecific antibodies.

For further information on this domain, check our report here.

RootsAnalysis – Research Insights

You may also be interested in the following titles:

- China Biopharmaceutical Contract Manufacturing Market, 2020 – 2030

- Continuous Manufacturing Market (Small Molecules and Biologics), 2020 – 2030

- Prefilled Syringe Fill / Finish Services Market, 2020-2030

The post Outsourcing: An Attractive Option For Antibody Production appeared first on Blog.