What You Should Know:

– New Chilmark Research report on artificial intelligence (AI) for healthcare operations forecasts a market poised for explosive growth with a CAGR of 40% over the next 5 years as solutions mature and more use cases demonstrate ROI.

The COVID-19 pandemic has irrevocably expedited adoption of enterprise augmented and artificial intelligence (collectively AI) solutions in healthcare to modernize operations. Burnout and staffing shortages, discharge planning, supply chain interruptions, new contracting models, and other operational challenges have all contributed to quickly making these technologies business-necessary to keep many healthcare organizations (HCOs) functioning. The latest report from Chilmark Research, Augmented Intelligence for Healthcare Operations (AI4Ops), examines an emerging niche of the industry poised for explosive growth as more ‘mature’ solutions effectively demonstrate the ROI of their client implementations.

AI in Operations (AI4Ops) Vendors

Several vendors are rapidly moving towards building platforms that are end-to-end solutions for operations, rather than simply developing point solutions. The many acquisitions and investments that have taken place over the past 18 months show that buyers and developers are focused on early financial wins, competing across operations and revenue cycle management functional areas wherein ROI can be easily quantified. In addition, the nature of some of these solutions is strong enough that vendors are exploring taking on risk in their contracts, offering ROI-based contracting for their services as they assert the value of their platform.

Augmented Intelligence Operational Use Cases

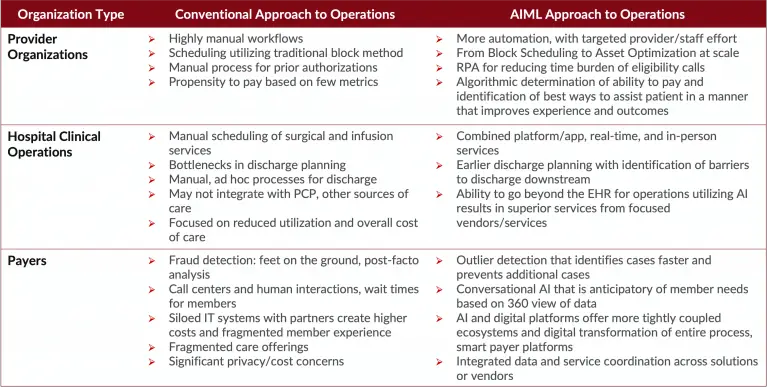

The report covers a number of operational use cases that the current ecosystem of vendors offers:

– Discharge Planning: ER management, Discharge barriers, Perioperative

– Hospital Operations: Staffing, Hospital beds, Surgery, Asset optimization

– Revenue Cycle Management (RCM): Intelligent claims management/denial prevention, Prior authorizations/eligibility, Patient ability to pay, Fraud detection

– Supply Chains: Predictive caseloads, Supply chain forecasting, Resource prioritization

When asked about the findings of the research, lead analyst Jody Ranck had this to say about the current market trends, “While there has been a great deal of focus on virtual care and the pandemic, a lesser-known story is the significant role of AI for operations platforms in helping hospitals and providers meet the financial, scheduling and supply chain challenges wrought by COVID-19. The solutions available today are surprisingly more mature than many other application areas for AI and machine learning.”

Vendors Highlighted in Report

A representative cohort of ten leading vendors providing solutions to address these needs are profiled in detail. The organizations who have developed products that meet the parameters of this research are: Change Healthcare (Flagship Vendor for RCM), Codoxo, Health Catalyst, Hospital IQ, Infinitus, LeanTaaS (Flagship Vendor for Asset Optimization), Olive, Premier, Qventus (Flagship Vendor for Hospital Operations), and Waystar. Smart money is catching on to the potential market for reducing overhead and administrative waste in healthcare, with recent investments and M&A activity in this space reflecting that. To date, this space is still largely untouched by the larger, incumbent platform vendors, so expect acquisitive behavior in the coming year from these stakeholders.

Healthcare Augmented Intelligence Still In Its Early Days

Although relatively early in its days of implementation, dividends from investments in the operations space are beginning to emerge. As a critical piece in the overall picture of digital transformation, AI4Ops will continue to relieve the burden on an already stressed healthcare system and should prove a testing ground for developing trust in AI offerings within the healthcare industry. While risks remain when implementing these solutions, they are not as dire as the potential risks posed by clinical decision support or other care delivery-centric solutions; though all stakeholders will still need to be vigilant when checking for bias in their algorithms.

This report is available to subscribers of the Chilmark Advisory Service or may be purchased separately.