Each week I’ve been adding a brief tidbits section to the THCB Reader, our weekly newsletter that summarizes the best of THCB that week (Sign up here!). Then I had the brainwave to add them to the blog. They’re short and usually not too sweet!–Matthew Holt

In this week’s health care tidbits, I can’t quite leave the $3.5bn Babylon Health SPAC investor document alone. Yes, it’s crazy but not as crazy as you might think. Essentially it’s saying that it’s going to be a better tech enabled version of Oak Street or Agilon. Babylon has put less effort into the medical group management side of the puzzle than Oak Street or Agilon but it hasn’t done nothing. It’s been running GP clinics in the UK for years and now has two Medicare Advantage networks in California w 52k lives. It only did $79m in rev in 2020 but that was presumably mostly in software. They’re aiming for $320m in rev in 2021 (presumably mostly from the medical groups) & $710m in 2022.

In comparison Oak Street’s forecast is $1.3bn in 2021 and $2bn in 2022. So Babylon is shooting to be 25% of its size. Today’s Oak Street market cap is ~$14,5bn, so 25% of that is close to the $3.5bn Babylon is trying to get investors to pay.

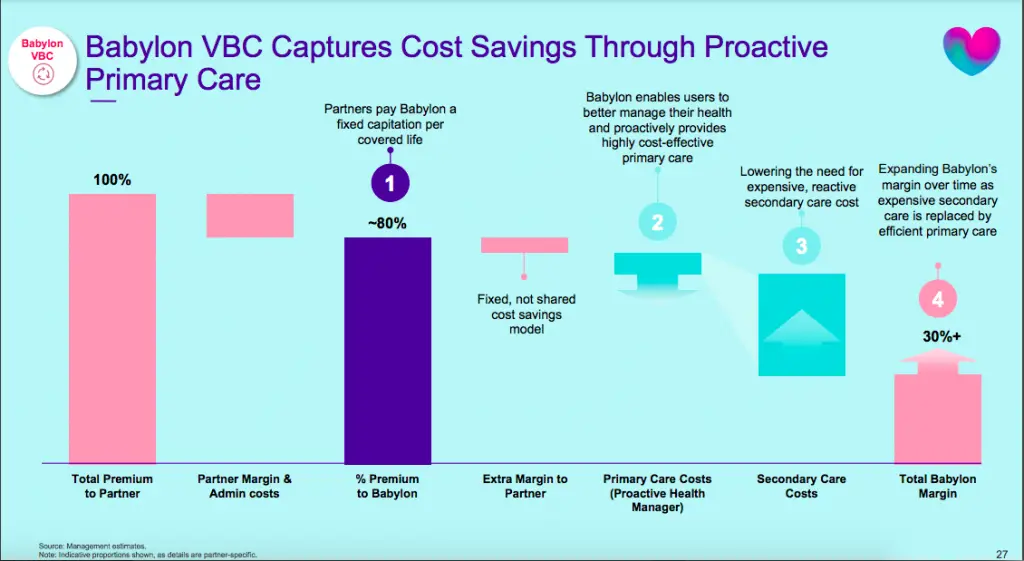

Then there’s the story, which is that the bot tech can reduce all types of patient health spend which will increase the margin. Of course their actual mileage may vary. I do love the chart from their investor prez, which not only assumes that they can reduce medical spend abut also that they get to keep those savings long term. I’m not sure the “Partner” in the chart below will be as convinced.

This was the cause of much hilarity on this week’s #THCBGang.

As I said crazy but not completely crazy. And you never know, maybe better care?