What You Should Know:

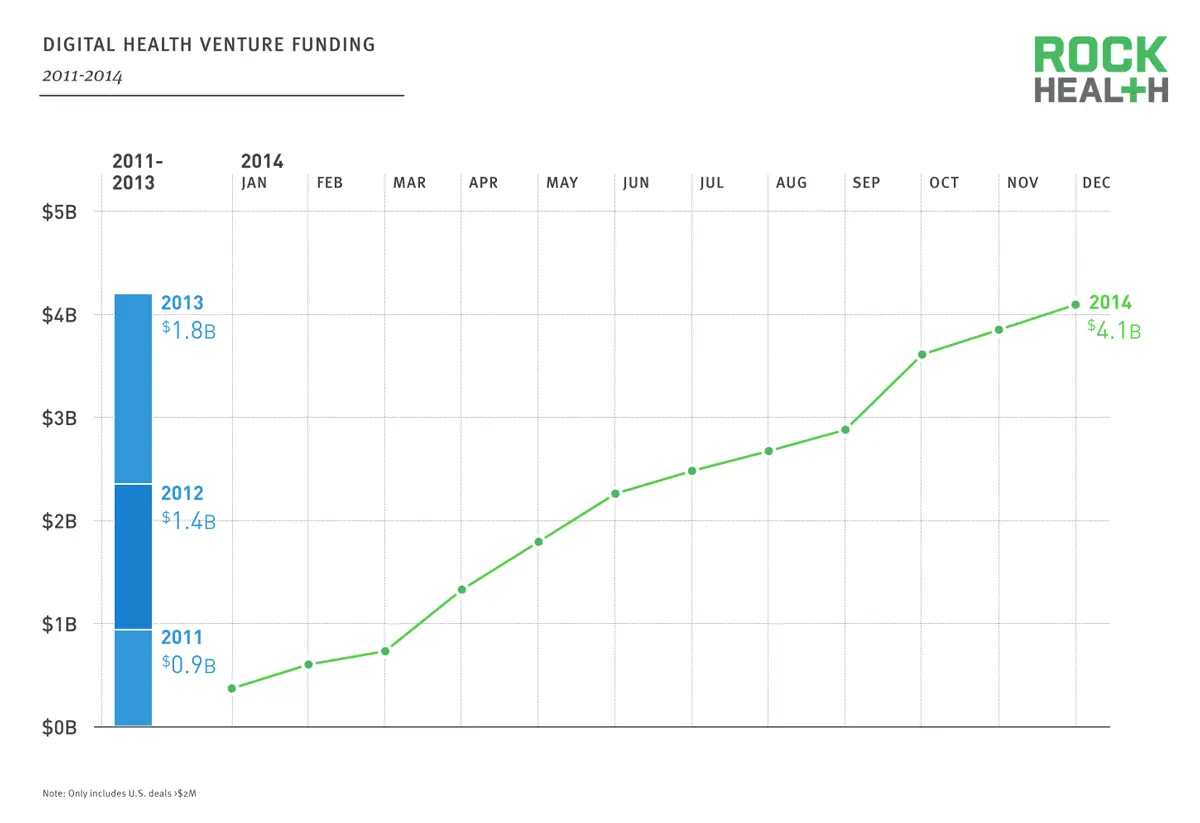

– Digital health funding reached a record-breaking $4.0B in

Q3 2020 for a total of $9.4B year to date, according to the latest Rock Health

quarterly report.

– Twenty-four (24) digital health companies have raised

mega deals of $100M or more through Q3 of 2020. The rise in mega deals reflects

a trend towards capital concentration in digital health venture investment.

– On-demand

healthcare services is the top-funded value proposition with $2.0B invested

across 48 deals through Q3 2020; it is also the value proposition with the most

number of deals.

Digital health

funding reached a record-breaking $4.0B in Q3 2020 for a total of $9.4B

year to date as it continues to be the largest funding year ever, according

to Rock Health, a full-service

venture fund dedicated to digital health.

Despite the COVID-19 pandemic, the stock market’s sharp

recovery and pandemic-initiated policy and regulation changes are driving large

competitive moves and commercialization activities in the digital health

sector. The Digital

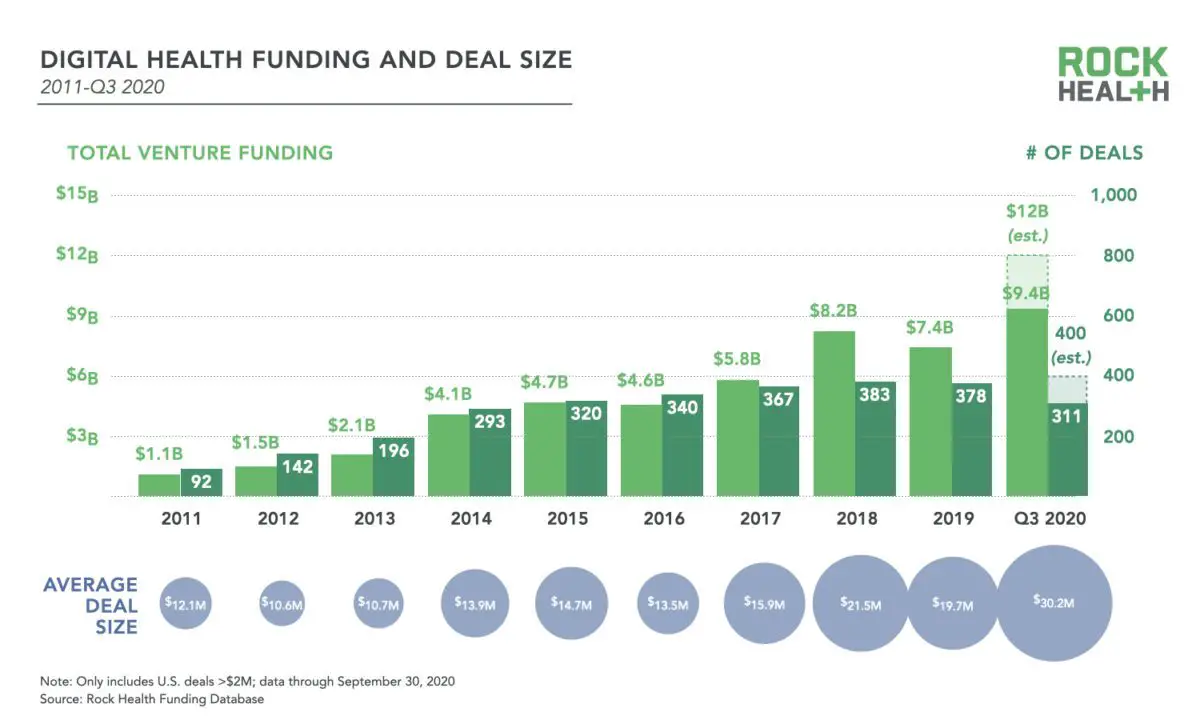

Health Market Insights: Q3 Update report reveals 24 large mega deals are

driving the top-line numbers. The average deal size in 2020 is $30.2M, 1.5

times greater than the $19.7M average in 2019.

Impact of COVID-19 Accelerating Digital Health Adoption

Since April, Rock Health reports the COVID-19 pandemic has accelerated

digital health

adoption as it attracted interest from consumers, investors, and entrepreneurs.

Deal volume through Q3 in 2020 is up nearly 22% compared to all of last year.”

This activity comes amidst a record stock market rebound and hopes for a vaccine before the end of the year—however, medium-term economic uncertainty still looms. The

impending risk of future outbreaks, lockdowns, and the upcoming presidential

election all create uncertainty around recovery.

Here are three key trends to know from Rock Health’s latest

report:

1. Mega deals are on the rise—particularly in virtual

care delivery, R&D enablement, and fitness & wellness

Twenty-four (24) digital health companies have raised mega

deals of $100M or more through Q3 of 20201. This already doubles the previous

annual record of 12 mega deals set in 2018. These deals account for well over

one-third (41%) of total digital health funding so far this year with connected

fitness company Zwift raising the largest round so far—$450M in Series C

funding.

Rise of On-Demand Healthcare Services

Rock Health reports that on-demand healthcare services, representing

telemedicine services, prescription delivery, and at-home urgent car is the top

funded value-proposition with $2.0B invested across 48 deals through Q3 2020. 56%

of on-demand healthcare services deals were Series B or later, and Series B or

later deals represented 87% of funding for on-demand healthcare services

startups. The top three funded deals in the on-demand healthcare services

category are Alto Pharmacy ($250M), Ro ($200M), and AmWell ($194M).

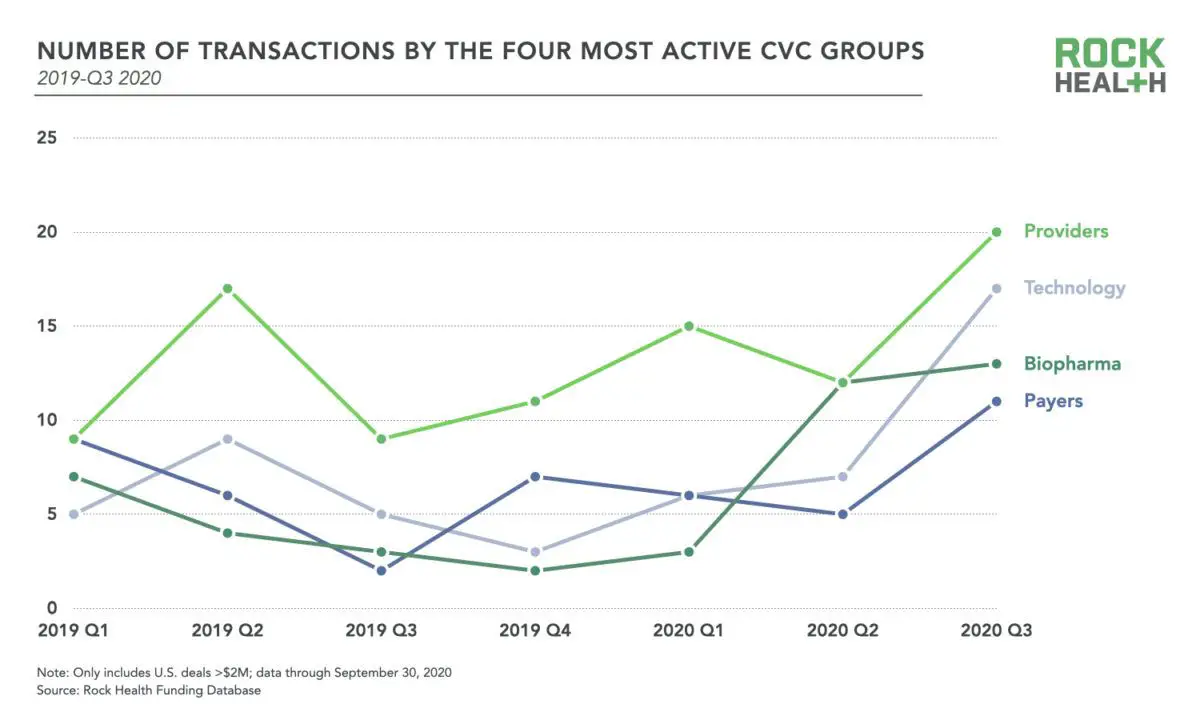

2. Corporate investors double down on digital health

Sixty-four percent (64%) of this year’s investors have

previously made investments in digital health—higher than any previous year.

Institutional venture firms continue to account for the largest share of

transactions (62%), with corporate venture capital (CVC) holding steady at 15%

of transactions.

– Corporate investors have made 149 investments in digital

health across three quarters this year, which already exceeds the previous

record of 145 investments across all of 2017.

– Quarterly investments by the four most active CVC

groups—providers, technology companies,8 biopharma, and payers—are all trending

upwards over the last 12 months.

– Provider CVCs lead the way with at least 12 investments

per quarter in each of the last three quarters.

3. Digital health companies capitalize on the stock

market’s sharp recovery and relaxed regulations

IPOs

Several digital health companies went public over the summer

or have announced plans to do so:

– Accolade and GoHealth went public in July

– Amwell, Outset Medical and GoodRx went public in September

high-growth, D2C platform Hims Inc. has struck a deal to go

public by merging with a blank-check company, and MDLive’s CEO announced

intentions to take the company public early next year. There were only six

digital health IPOs in 2019.

M&A Activity

Overall M&A activity is down in 2020 compared to prior

years. There have been 63 acquisitions of digital health companies through

Q3—on track to fall short of the 113 last year and 115 average from the prior

three years.

Rock Health Report Background & Methodology

The report produced by Sean Day and Elaine Wang with help

from Megan Zweig, Bill Evans, Jasmine DeSilva, Claire Egan Doyle, Derek Goshay,

and Nina Chiu sources data from Capital IQ, SEC company websites, Crunchbase,

NVCA, press releases, and the Rock Health funding database. Rock Health funding

data only includes disclosed U.S. deals over $2M.