By JEFF GOLDSMITH

These are grim days for innovative healthcare companies. The health tech and care innovation firms mature enough to make it to public markets have been eviscerated in the ongoing market correction. As of January 29, 2022, high fliers like One Medical (down 83% from peak), Oscar (down 83%), Bright Healthcare (down 85%), Teladoc (down 77% but still selling at 6X revenues!), and AmWell (down 90%) are the tip of a much larger melting iceberg. The dozens of digital health unicorns (e.g. pre-public companies valued at more than $1 billion) and their less mythical brethren, into which investors poured more than $45 billion during 2020-2021, are sheltering in the comparative safety of VC/Private Equity balance sheets. They are protected from investor wrath until those firms’ limited partners force a revaluation of their portfolios based on the market value of their publicly traded comparables.

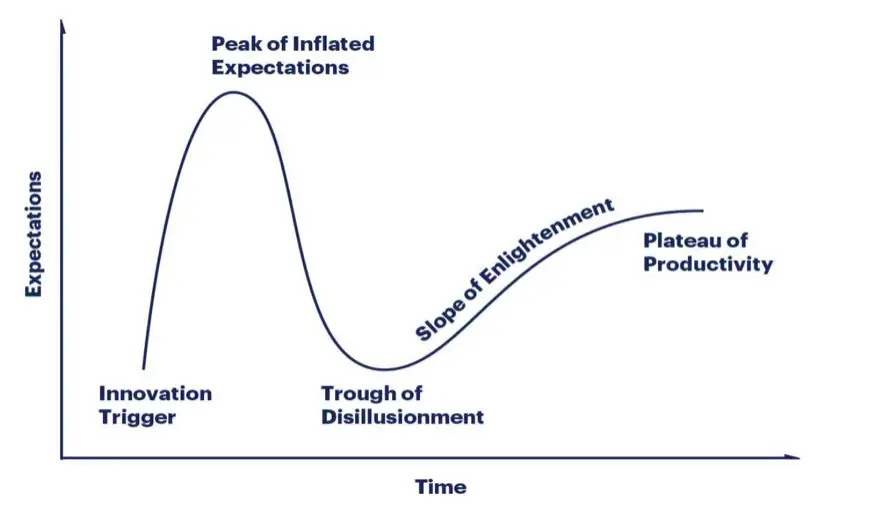

Yet it is the next moves that these innovative firms and their equity holders make that will determine whether these firms realize their full transformative potential or fade into insignificance. The Gartner Group, which tracks the technology industry generally, popularized the notion of the Hype Cycle- a seemingly universal trajectory that tech innovations and the firms that produce them follow (see below).

The Gartner Hype Cycle

Everyone seems to focus on the colorful first phase of this cycle- the inflating and deflating part- where an innovation rises on a wave of the adulatory press (and breathless futurist punditry), then crashes ignominiously into the Slough of Despond. A classic example was the Apple iPhone’s ill-starred great uncle, the Apple Newton, which launched in 1993 and crashed shortly thereafter.

For founders and investors, as well as customers, however, it is the less visible succeeding phases that determine if the innovation survives and the firms that produce them become ubiquitous and indispensable parts of our lives. The rising initial phase of Gartner’s Hype Cycle is driven by the question “Is it cool”?, mediated by hyperactive media and Internet buzz. The inevitable crash, on the other hand, is almost always driven by the troublesome real-world question, “Does the product actually work as advertised?” Analysts, writers, and, most importantly, customers press uncomfortable questions about not only functionality, but also reliability, affordability, stickiness, and “value for money”.

How do firms survive the crash and climb Gartner’s “Slope of Enlightenment”? This is the unglamorous “pick and shovel” part. If the sticky “product integrity” issues (does the product actually work?) are resolved, then a host of important questions challenge the firm, its founders, and owners, which answers the crucial question: whether it is a real business:

- Product-market fit (e.g. how, precisely does the innovation create value for customers and for whom?) Who are the actual customers for the product? Does the product need to be modified to meet their needs?

- Business model (e.g. can we be paid adequately by those customers for what we produce?),

- Scalability (can we actually deliver the product at scale sufficiently to, at some magic point, return investors’ capital?) and, crucially,

- Management (do we have the right people in key positions?).

Investor wisdom and judgment are the crucial ingredients here. At this point, if investors act decisively, the Adam Neumanns and Travis Kalanicks are ejected from the firms they founded, and more experienced and capable managements are recruited to manage this complex process. In the event that the owners cannot satisfactorily answer the ultimate existential question- is this a real business?- equity holders may decide to exit, and sell the business and its problems to others.

Teladoc and AmWell began the rolling up process years ago, before the 2020/2021 explosion in digital market caps. Whether they have cleaned up the problems they inherited with their acquisitions remains to be seen. Private equity-funded startups are now aggressively competing to be dominant full-stack. multi-product platforms, a space that has gotten absurdly crowded very quickly. It is possible that no one actually wins the platform wars presently underway. There is tremendous dynamism and promise in digital health, not only in digital care provision, but also infrastructure that automates or simplifies payment transactions, facilitates hard connections to care systems, and coordinates different modalities, including AI-assisted chatbots, avatars, and other communication tools.

It is not challenging to identify the consolidators of digital health that will emerge in this sorting and revaluation process. The first and most significant among them is UnitedHealth Group’s Optum subsidiary. United has almost $70 billion in cash, piling up at the astonishing rate of $2 billion a month. United/Optum has the management discipline to wait, select carefully and not overpay. But other large incumbent healthcare actors will play a key role, including CVS/Aetna, HCA, Anthem, CIGNA, Ascension Health, Pittsburgh’s UPMC, Intermountain Healthcare, etc. all of which have made cautious forays into the sectors presently correcting- digital health, Medicare Advantage and at-risk primary care.

In another promising approach, Intermountain, in partnership with two other large care systems, has created a non-profit “market-making” enterprise called Graphite Health (https://www.graphitehealth.io) that will act as an “App Store” for digital health solutions. Graphite is intended to fill a critical gap- the lack of digital health performance standards- efficacy, safety, and cost-effectiveness- that makes it difficult or impossible for institutional purchasers (not to mention patients) to make rational choices among a welter of competing options.

And of course, there will be the hungry outsiders that wish a larger healthcare presence- notably Amazon, Walmart, and Microsoft – that have made recent investments targeted at key health industry segments -pharma supply chain, urgent care, speech recognition, e.g. Transaction costs and complexity of integration will create huge income streams for bankers, the legal community and consultants, who win regardless of the payoffs for founders and equity holders.

The crash into Gartner’s Trough of Disillusionment is not the end of the game.

The unglamorous but crucial Darwinian process of weeding out the opportunists and fabulists from the real businesses- the enterprises that will change our lives- is just beginning. This process will stretch out over the remainder of this decade.

Jeff Goldsmith is the President of Health Futures, Inc.