Over the past decade, numerous scientific and technological breakthroughs in the medical device industry have resulted in an accelerated pace of research and innovation within this domain. Further, the demand for high quality and efficient medical devices, driven by a growing geriatric population and increasing incidence of various chronic clinical conditions, is on the rise. However, one of the primary challenges faced by this industry is the complex and time-consuming product development lifecycle of a new medical device. Specifically, the clinical stage is exceedingly resource intensive, involving high costs and greater risks.Furthermore, new advancements have facilitated the development and enforcement of more informed regulatory guidelines and instructions to ensure the safety of medical devices. Subtle differences in regulatory guidelines across various geographical regions need to be considered by medical device developers in order to receive approval in different markets. This has further resulted in longer trials, higher costs (due to rise in patient enrollments), and increased time-to-market. In order to overcome the abovementioned challenges, medical device developers are actively outsourcing their clinical research and associated operations to specialized medical device CROs, which are known to have the required capabilities and expertise.

The medical device sector is one of the few businesses that has been relatively less impacted amidst the COVID-19 pandemic. Moreover, as the disease spreads, the demand for accurate diagnostic measures, medical devices (including handled scanners, and personal protective equipment (PPE)), and effective preventive and treatment solutions for COVID-19, is growing at a rapid pace. In this context, it is worth mentioning that the sales of handheld ultrasound / x-ray scanners and infrared thermometers have increased manifold, in compliance to social distancing guidelines. In fact, the medical device industry is presently overwhelmed with the need to develop and supply various types of products to cater to the ongoing COVID-19 testing initiatives, across the world. As more cases of the disease are identified, restrictions imposed on both national and international movement of goods are anticipated to impact the import / export of medical devices, as well. In order to address this problem, it is very important for MedTech manufacturers to be flexible in their operations, leveraging all applicable exemptions, and optimizing internal processes by fulfilling emerging needs through innovation. Further, in general, any strategy conceived / deployed in this crisis must be communicated in an effective manner, across both public and private stakeholders in the industry.[3]

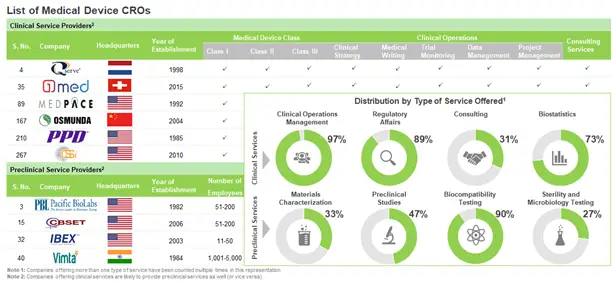

Over 300 CROs presently offer a wide range of preclinical and clinical research-related services to medical device developers

It worth noting that more than 85% CROs offer clinical development services to sponsor companies. Further, the market is currently dominated by the presence of very small and small companies (less than 51 employees), that represent over 50% of the total players. In fact, in the past few years, the domain has witnessed the establishment of several start-ups.

More than 70% of medical device CROs are based in North America and Europe. Within North America, majority of the service providers are headquartered in the US, in fact, over 50% of preclinical service providers are US-based; whereas, in Europe, most of the CROs are distributed across France, Germany, Switzerland, Spain, Italy and Sweden. Further, a significant number of such players (30%) are headquartered in Asia-Pacific and other developing countries of the world.

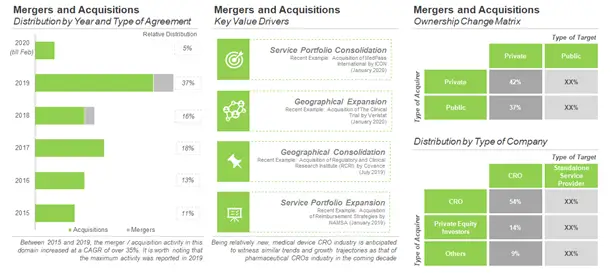

Deal Making in Medical Device CRO Domain

The medical device CRO domain is witnessing significant consolidation activity since the past few years. This can be attributed to the rise in competition within this domain, which has further compelled medical device service providers to diversify their portfolios through mergers and acquisitions. More than 35 instances of mergers and acquisitions have been reported in this domain, during the period 2015 and 2020 (till mid-March).

Majority of the deals in this domain were acquisitions (92%). It is worth noting that, of the total number of acquirers, 58% were privately held firms, while the rest were public companies. However, majority (94%) of the acquired companies were private companies.

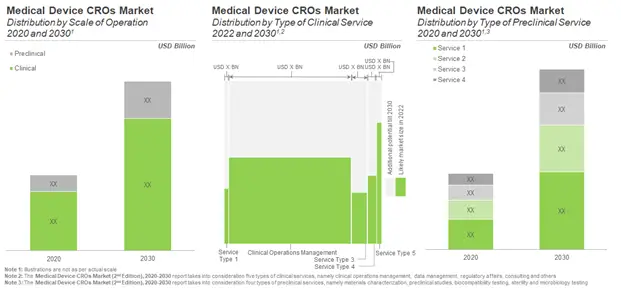

Medical Device CROs Market to Grow at a Healthy Rate in the Foreseen Future

Over the years, outsourcing has become an indispensable business strategy within the global medical devices market. Moreover, the increasing regulatory stringency worldwide, is causing many innovator companies to rely on the expertise of CROs to liaise regulators and handle the intricacies associated with product approval. According to our estimates, the overall medical device CRO market is anticipated to grow at an annualized rate of 6.4%. The demand for such contract services is likely to be driven by clinical stage operations (78%), with the maximum share of revenues expected to come in from clinical trial management services (68%), both in the short- and mid-long term. This is anticipated to be followed by data management services, which are expected to contribute to 16% of the total share by 2030. Other important service segments include regulatory services (5.9%) and consultancy services (4.4%).

The share of preclinical service providers is estimated to be over 20% of the overall market, with the largest share of revenues expected to come in from sterility and microbiology testing services (35%). This is likely to be followed by biocompatibility testing services (31%), and material characterization and analytical services (20%).

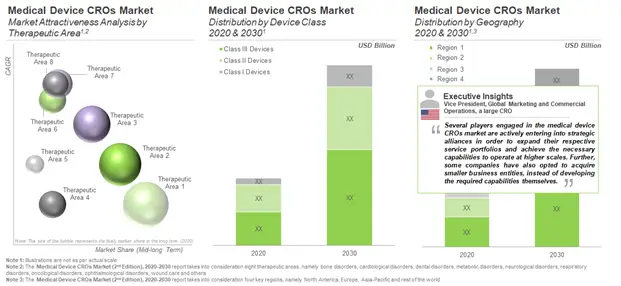

In the long term, service revenues for medical devices intended for the treatment of CNS disorders (14%) are expected to make up a relatively higher share of the market. This is attributed to the anticipated growth in number of clinical trials of devices targeting Parkinson’s disease, Schizophrenia and strokes. It is likely to be followed by revenues from services offered for devices intended for catering to cardiovascular disorders (12%), oncological disorders (11%) and bone disorders (6%).

In terms of service revenues generated across difference device classes, class III devices are presently estimated to be responsible for the largest share (48%) in the overall medical device CRO market, followed by class II (45%) and class I (7%) devices. As of 2020, the contribution of service providers in North America is likely to be the largest (41%) in the overall medical device CROs market. This is likely to be followed by stakeholders in Europe and the Asia-Pacific, representing 32% and 25% shares, respectively.

Visit this link for more Insights.

Medical Device CROs Market (2nd Edition), 2020 – 2030

You may also be interested in the following titles:

- China Biopharmaceutical Contract Manufacturing Market, 2020 – 2030

- Continuous Manufacturing Market (Small Molecules and Biologics), 2020 – 2030

- Prefilled Syringe Fill / Finish Services Market, 2020-2030

The post Medical Device CROs – The next Growth Opportunity appeared first on Blog.