Recently the CBO published a report compared the rates public and private insurers pay to hospitals for inpatient services, for services at hospital outpatient departments (HOPD), and at ambulatory surgical centers (ASC). A recent RAND report aims to do a similar exercise but contributes to the literature by using updated data from more states, allowing for comparisons between HOPD and ASC. These data come from health insurance claims data form three sources:

- state-based all-payer claims databases

from Arkansas, Delaware, Colorado, Connecticut, Maine, New Hampshire, Oregon,

Rhode Island, Utah, Vermont, and Washington - self-insured employers

- health plans

Note that the sample of self-insured

employers and health plans is a convenience, not a representative sample. Also, the all-payer database disproportionately

covers States in the Northeast and Northwest.

Despite the fact that the sample is not full representative, a key

benefit is that the data contained allowed amounts (i.e., amounts actually paid

including patient out-of-pocket cost), not hospital charges.

The authors calculate differecnes in

prices two ways:

- Standardized

prices, meaning the average allowed amount

per standardized unit of service, where services are standardized using

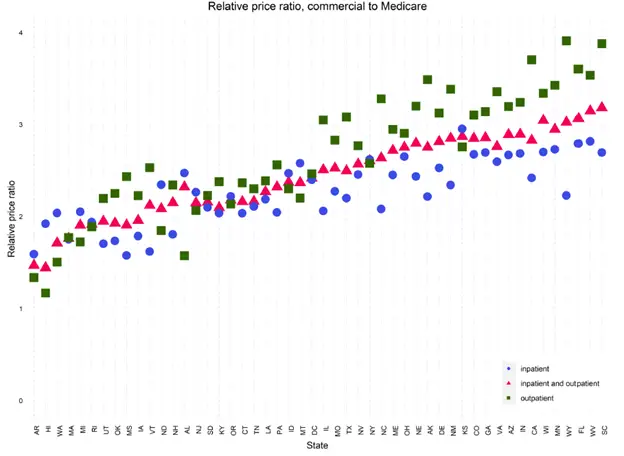

Medicare’s relative weights - Relative

prices, meaning the ratio of the actual

private insurer–allowed amount divided by the Medicare-allowed amount for the

same services provided by the same hospital

Relative prices have the advantage of

looking at the actual price ratio including Medicare adjustments for case mix,

wages, inflation, and medical education; standardized prices allow for

comparison of non-Medicare payers to a single nationalized Medicare rate

(without adjustments).

Hospital data was also linked to AHRQ’s

Compendium of U.S. Health Systems.

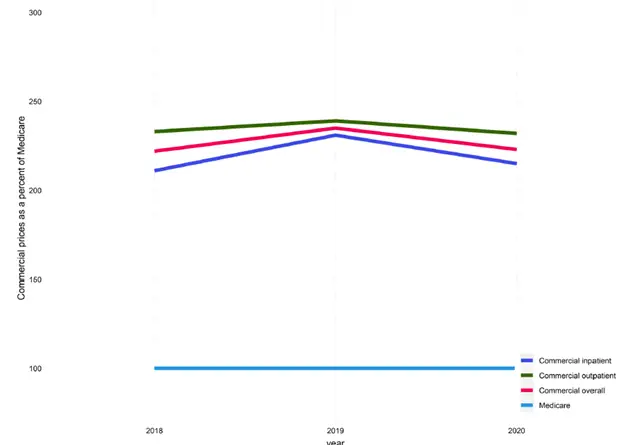

In 2020, when comparing hospital services for commercial vs. Medicare, the average overall relative price was:

- Overall: 224 percent of Medicare prices

- Inpatient services: 217 percent

- Facility payments: 235 percent

- Professional services: 163 percent

The study also examines the

relationship between price and quality.

There does seem to be a positive correlation between price and quality,

but this relationship is fairly weak.

…lower-priced hospitals—those with prices less than 150 percent of Medicare (361 hospitals)—have lower-quality scores than higher-priced hospitals (1,402 hospitals). However, medium-priced hospitals, those between 150 and 250 percent of Medicare (1,409 hospitals), have the highest share of hospitals with five-star ratings. Among high-priced hospitals, 22 percent received five stars and only three percent received one star, whereas among low-priced hospitals, only 14 percent received five stars, while 17 percent of hospitals received one star.

Prices for outpatient surgery was

higher for commercial compared to Medicare patients but the ratio is much

smaller in magnitude than inpatient services.

- ASC: 162 percent of Medicare cost

- Hospital outpatient (APCs): 117 percent