What You Should Know:

– Tebra, the digital backbone for independent healthcare practices, announced that it has closed more than $72M in funding at a valuation greater than $1B.

– This capital infusion will accelerate Tebra’s merger plans including expanding market share, developing and launching the combined product line and advancing the new branding for the company. Tebra supports over 100,000 providers who are delivering care to more than 90 million patients in the U.S.

Digital Backbone for the Connected Healthcare Practice

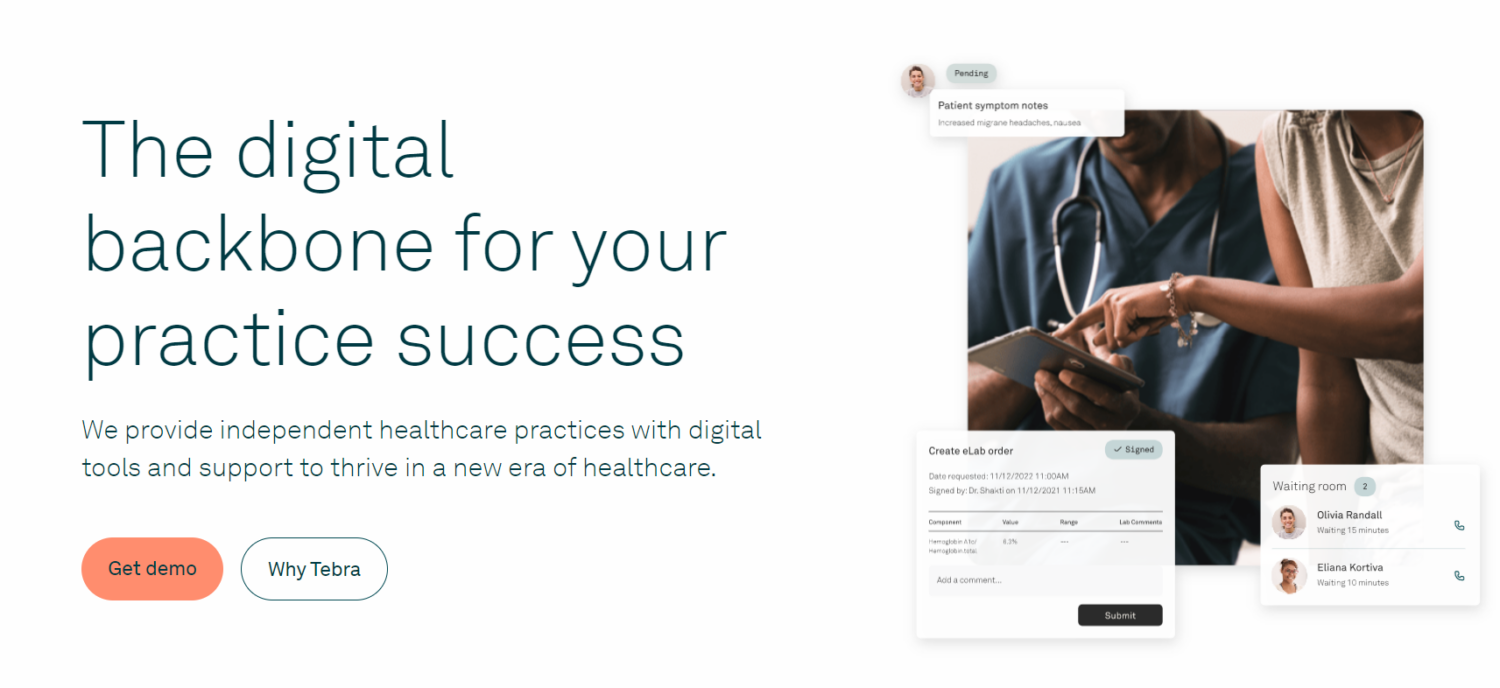

Consumers expect digital access, simplicity and convenience in all aspects of their lives. You can quickly research and order a meal online, hail a ride, and buy a car from your smartphone. Meanwhile, healthcare has been left behind in a sea of complexity and fractured solutions. Tebra provides independent healthcare practices with a complete operating system for practice success. Built through the combination of Kareo and PatientPop, the offering includes modern websites, messaging and scheduling, telehealth, EHR, care delivery, practice management, billing, payments, and analytics.

Since the companies merged in late 2021, the company has successfully built and launched a two-way product integration that allows both platforms to share scheduling information and physician availability. The integrated solution also reviews appointment information and sends out surveys for better reputation management. Over 800 providers now use the combined operating system, and the company plans to grow significantly both into their existing base and the healthcare industry at large.

From practice growth technology to clinical and financial software, Tebra’s complete operating system is structured to modernize every step of the patient journey and support the connected practice of the future. Headquartered in Southern California, the company currently has over 1,000 employees.

“We are delighted to be a long-standing financing partner to Tebra, supporting them through multiple growth phases, add-on acquisitions and new product development since 2017,” said Peter Fair, Managing Director at Golub Capital’s Late Stage Lending team. “Our mission is the success of our clients and being able to offer flexible solutions that meet the changing goals of their business.”