What You Should Know:

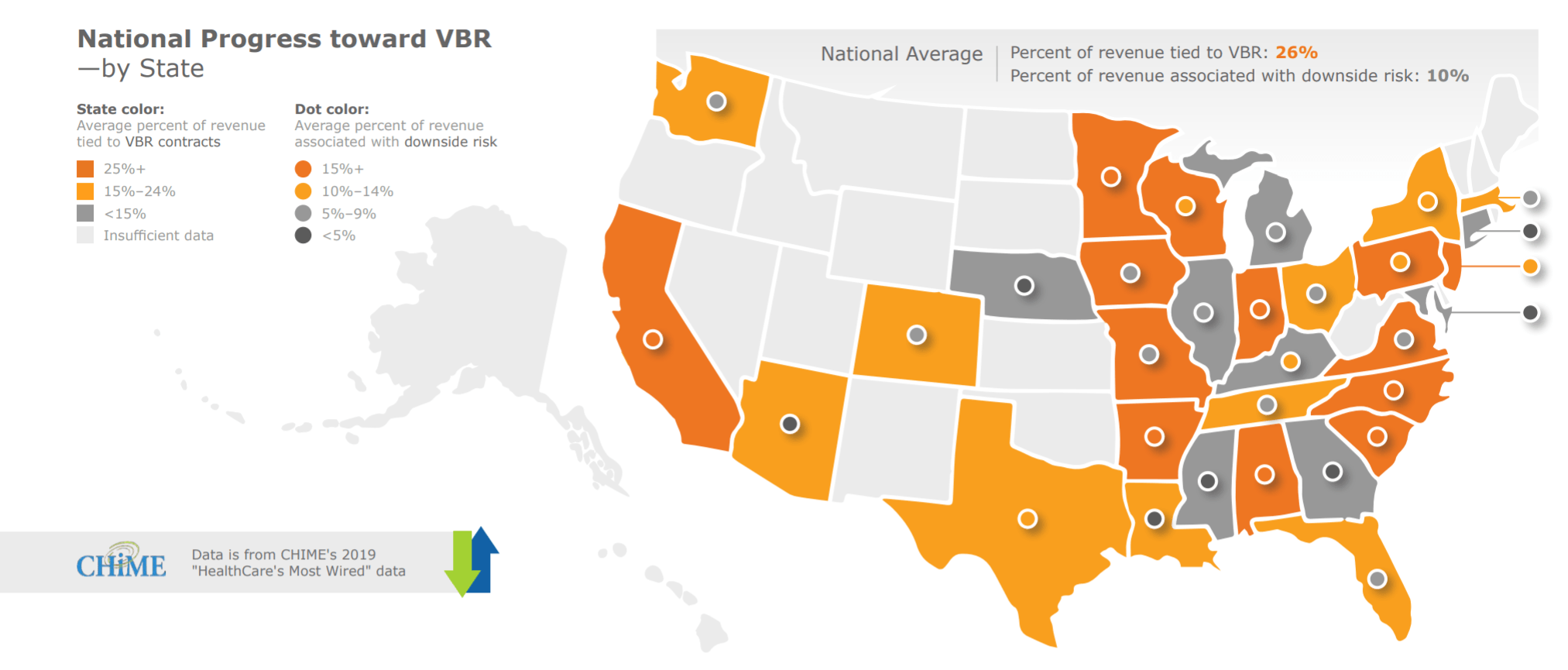

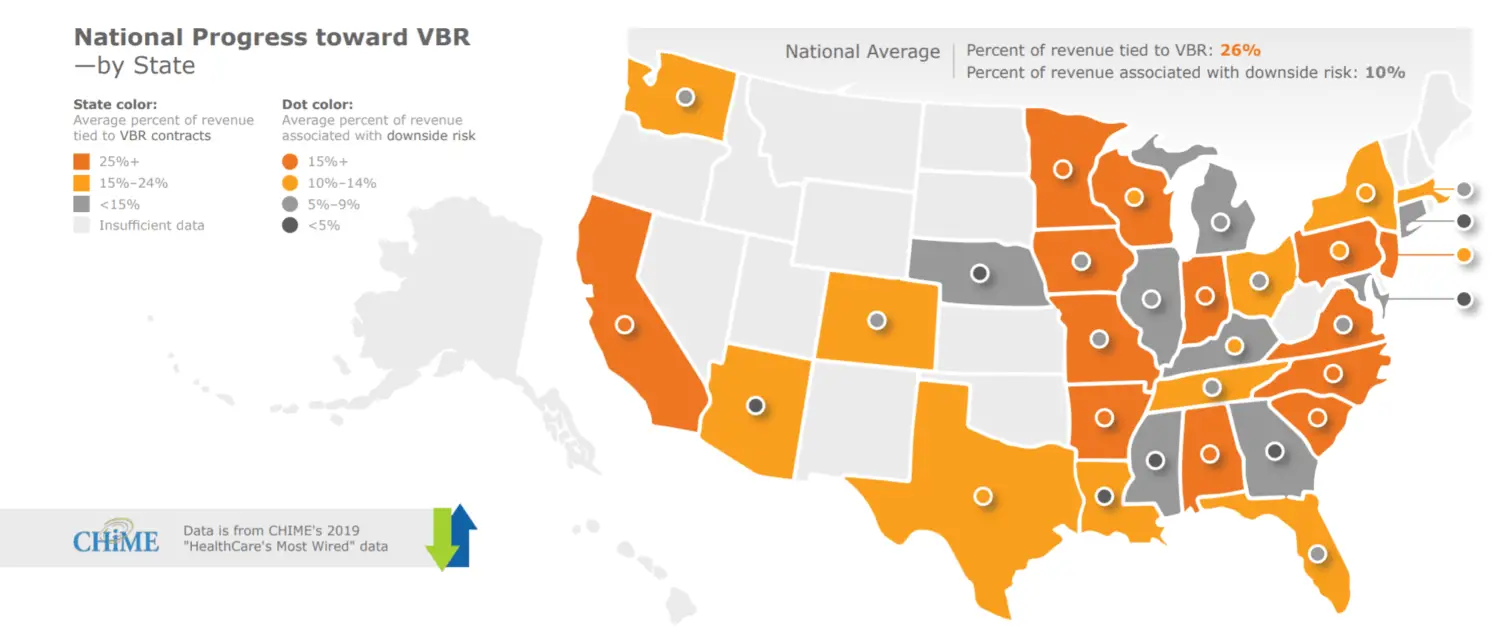

– Value-based reimbursement (VBR) contracts now account

for 26% of hospital revenue, according to a new report from KLAS research and

CHIME.

– Report reveals providers are looking first to their

electronic health record (EHR) systems to drive PHM, and are most interested in

investing in new healthcare information technology (HIT) when they know there

is a clear ROI.

With value-based reimbursement (VBR) adoption slowing, healthcare providers are searching for ways to manage risk and achieve ROI on population health management (PHM) solutions adoption, according to a new report from KLAS Research and CHIME – the College of Healthcare Information Management Executives. The new report, issued, reveals that providers are looking first to their electronic health record (EHR) systems to drive population health management (PHM), and are most interested in investing in new healthcare information technology (HIT) when they know there is a clear ROI. The findings were based on findings from KLAS Decision Insights, the KLAS 2019 Population Health Management Cornerstone Summit, and CHIME’s 2019 HealthCare’s Most Wired data.

Value-Based Reimbursement in 2020: How Far Have We Come?

VBR contracts now account for 26% of hospital revenue. Fee-for-service still outpaces VBR, and over time, the lack of significant progress toward VBR has eroded healthcare organizations’ confidence that the change will happen in the near future. The biggest factors limiting the adoption of VBR are uncertainty that an ROI will be achieved and a lack of needed infrastructure.

How Is Technology Being Used to Support VBR?

Once organizations decide to invest in technology to help

with VBR, they generally turn first to their EMR. Though provider organizations

may not ultimately choose their EMR for certain population health management

(PHM) needs, EMRs are almost always considered, due to (1) assumed integration

with EMR data; (2) anticipated cost savings; and (3) increased ease of access

to PHM data in the EMR.

EMRs are slightly less likely to be used for administrative

and financial reporting—EMRs have historically struggled to provide the nuanced

views needed in these areas, so organizations often opt for third-party

solutions that provide additional analysis, visualization, and ad hoc reporting.

Third-party solutions may be used on their own or in conjunction with EMR

functionality.

Organizations invest in HIT when there is a concrete ROI

Solutions that help organizations identify and act on care

gaps see some of the broadest adoption as they can be helpful with just about

any VBR contract. Once a gap is identified, organizations need to reach out to

the patient and close it, so patient engagement tools are also highly sought

after.

Functionality is a significant driver in PHM purchase

decisions

Healthcare organizations are looking for enterprise EMRs and

broad BI platforms capable of tackling a large swath of their PHM and

VBR-related functionality needs (e.g., root cause analysis, A/B testing, etc.).

In this quest for consolidation, organizations are seeking to eliminate ad hoc

interfaces and replace vendors who haven’t delivered on functionality or

quality.

“Providers are trying to find positive ROI on their population health management investments,” said Adam Gale, president of KLAS Research. “This report offers a useful roadmap for how they can meet that challenge.”

For more information about the report, visit https://klasresearch.com/report/value-based-reimbursement-2020/1705